Money in Motion: Yield Ahead

As promised, here’s part two in my Money in Motion series. The Federal Reserve (Fed) and the U.S. federal government provided unprecedented responses to the market turmoil last week. Investors may begin to ask whether the time has come to begin positioning their fixed income portfolios for what comes next. This is exactly the question I wanted to address in this blog post.

When thinking about the situation, what instantly comes to my mind is the traffic sign we have all seen a million times: Yield Ahead.

The turmoil in the financial markets has afforded investors the opportunity to review their asset allocation profiles, and perhaps make changes they may have been reluctant to do prior to the current state of affairs. In my opinion, one of the most noteworthy items to consider is your interest rate profile.

With the Fed dropping the fed funds target into a zero interest rate policy, we should not expect to see a reversal on this front any time soon. However, other rates along the yield curve do have the potential to move higher. In fact, the further out in maturity one goes, away from fed funds, other factors (growth or inflation expectations, Treasury supply, rates abroad, etc.) come into play to determine the direction of yield levels.

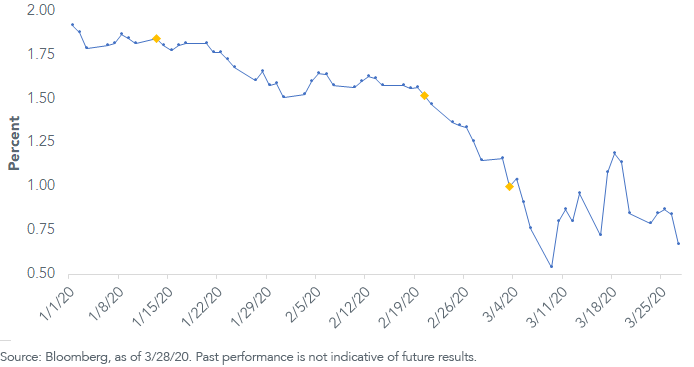

With that in mind, let’s take a look at the UST 10-Year yield’s behavior thus far in 2020. Obviously, the direction has been a one-way street to the downside, but there have been three key points to reference that may help to determine what could lie ahead if the yield begins a retracement to the upside.

- The first data point was January 13, when the 10-Year yield was at 1.85%. COVID-19 news was just beginning to filter into the market, which led to a more orderly decline down into the 1.50% vicinity.

- This lasted until late February when the stock market finally buckled, ultimately pushing the 10-Year down to its next drop-off point, and through the 1.00% threshold.

- Finally, the crescendo on March 9, when the 10-Year yield fell to its all-time low of 0.54% (0.31% in intra-day trading), with the catalyst being the Saudi/Russia oil price war.

We all know the story from here. Unprecedented monetary policy responses from the Fed and the U.S. government’s passage of a more than $2 trillion C.A.R.E.S. relief package. Unfortunately, ‘it will get worse before it gets better’ is now the mantra for the economy. However, the unparalleled amount of support and potential stimulus, that has been provided may, hopefully, be setting the stage for a solid rebound in activity later this year and in 2021.

But let’s not put the cart before the horse. Unfortunately, many challenges remain. In the meantime, there is a key factor that needs to be considered for the rate outlook. The U.S. federal budget deficit was already on course to surpass the trillion dollar mark this fiscal year. Where do you think it’s going now, and more importantly, how will funds be raised to pay for this surge in government outlays? That’s right, a massive increase in upcoming Treasury issuance.

Sure, the Fed’s apparently unlimited buying of Treasuries can put a cap on rates…no argument there. But as we saw in prior quantitative easing (QE) episodes, the UST 10-Year yield can still rise (the UST 10-Year has already moved back up to nearly 1.20% as recently as March 18) and the rate differentials between the sovereign debt of the US and other developed nations have narrowed considerably. Case in point: the spread between the US and Germany is the lowest since 2014.

So, what are fixed income investors to do? Where appropriate for your situation, we recommend fixed income investors reduce their long-duration holdings (hopefully ‘ringing the cash register’ in the process) and consider targeted duration strategies to mitigate potential rate risk as we move forward. From a strategic asset allocation standpoint, in our opinion, the barbell approach we have highlighted in the past has proven its time-tested worth. Investors should consider toggling the weight more equally between the UST floating rate note and core yield enhanced allocations.

The WisdomTree Floating Rate Treasury Fund (USFR), and the WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY) and can be used as the two barbell weights discussed here.

Unless otherwise stated, data source is Bloomberg, as of March 28, 2020.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on. Securities with floating rates can be less sensitive to interest rate changes than securities with fixed interest rates, but may decline in value. The issuance of floating rate notes by the U.S. Treasury is new and the amount of supply will be limited. The value of an investment in the Funds may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Funds’ portfolio investments. Due to the investment strategy of these Funds, they may make higher capital gain distributions than other ETFs. Please read each Fund’s prospectus for a discussion of risks.