Risk Factor Diversification: A Tale of Two Quarters

This article is relevant to financial professionals who are considering offering Model Portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness… it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us…

(From “A Tale of Two Cities” by Charles Dickens, first published in 1859)

To everything (turn, turn, turn)

There is a season (turn, turn, turn)

And a time to every purpose, under heaven

(From “Turn, Turn, Turn,” arrangement and melody by Pete Seeger and covered infinite times, most famously by The Byrds in 1965)

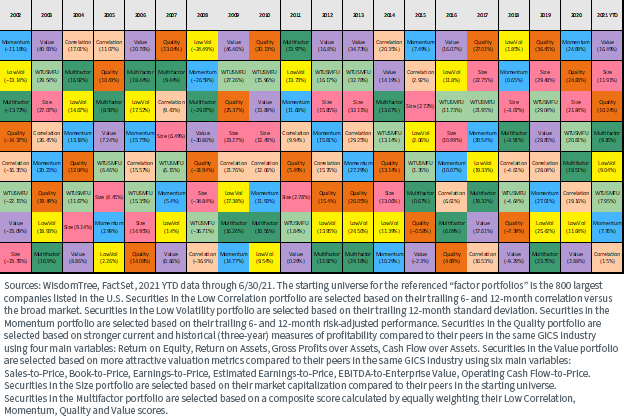

We have written about factor rotation and factor diversification quite a bit. But the first half of 2021 provides perhaps the most vivid illustration of why we believe risk factor diversification is so important when constructing Model Portfolios.

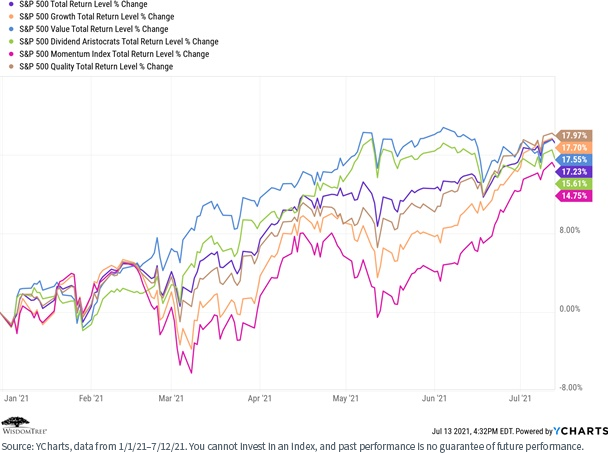

Let’s compare three charts of risk factor performances—year to date (YTD), first quarter (Q1) and second quarter (Q2)—for the S&P 500 Index.

First is YTD, which shows a distinct convergence of factor performances over the course of the year.

For definitions of terms in the table, please visit the glossary.

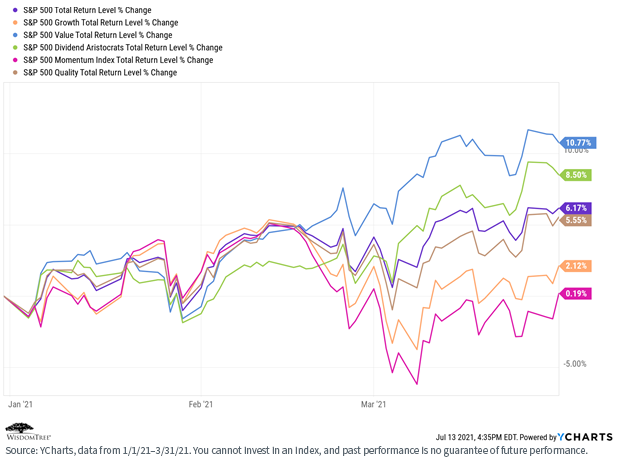

But now let’s break that YTD performance into Q1:

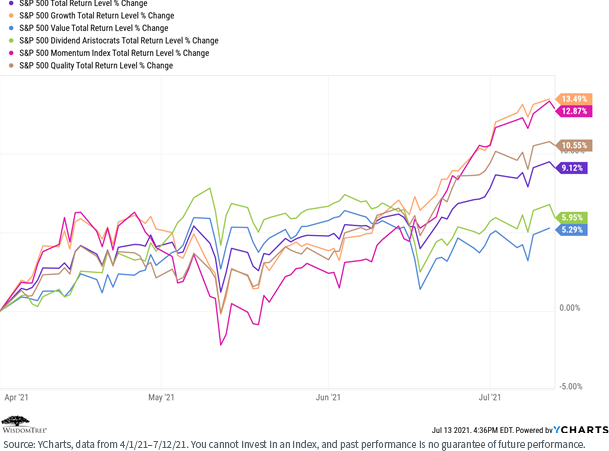

And Q2 (and slightly into Q3):

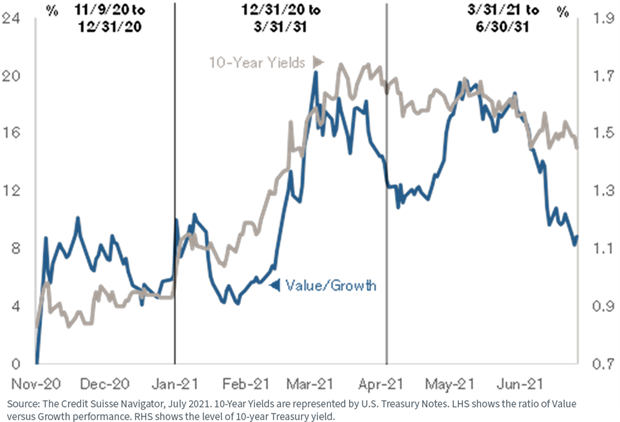

We see an almost total factor performance reversal. In Q1 (when interest rates were rising), the market was led by value, dividends and quality, with growth and momentum trailing far behind.

But since then (as interest rates have fallen), it has been exactly the opposite—growth, momentum and quality have led the way, while value and dividends dramatically underperformed.

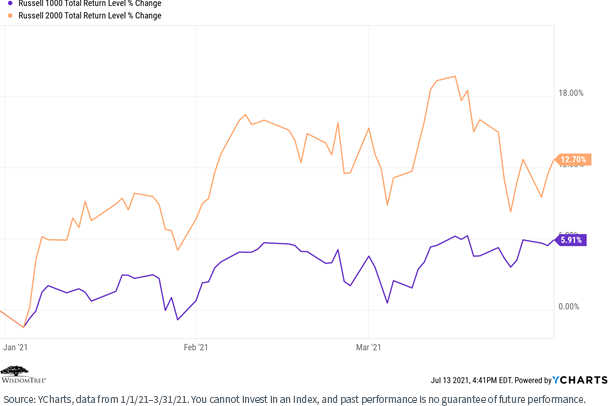

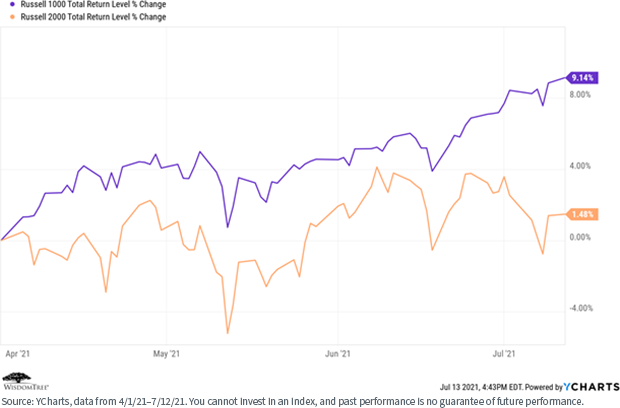

We see a similar trend if we compare large-cap to small-cap performance. In Q1, it was all small-cap, all the time.

For definitions of terms in the table, please visit the glossary.

Since then, however, we have seen a complete reversal.

We see a similar large-cap/small-cap reversal in EAFE markets as well. Only in emerging markets has the small-cap outperformance been consistent all year long, and, in fact, it accelerated in Q2.

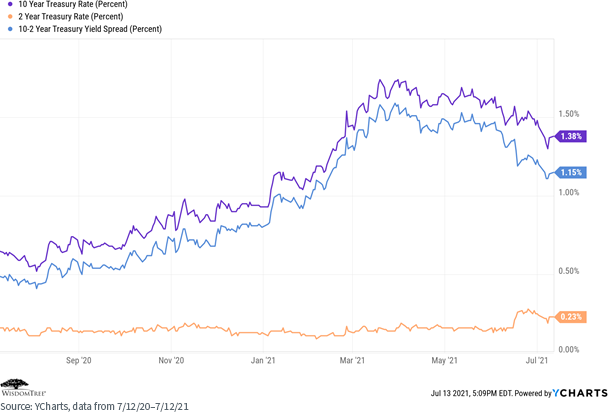

In some respects, these factor rotations have been tied closely to changes in interest rates. In Q1, when interest rates rose fairly dramatically, value stocks led the way. Since then, however, interest rates have fallen steadily, and growth has taken the lead.

At WisdomTree, we can and will take explicit factor tilts within our Model Portfolios from time to time as we believe market conditions warrant them. As an example, based on our opinion on where we were in the economic recovery cycle at the beginning of this year, we rotated out of an explicit momentum strategy (momentum has historically tended to lag in the early days of an economic recovery) and into a more explicit growth factor strategy. This trade has worked out very well for us so far.

Having said that, we also know that we cannot outsmart the market consistently, and furthermore, market conditions can change quickly and unexpectedly (such as the dramatic turnaround in interest rates beginning in Q2).

It is for this reason that all WisdomTree models are both asset class and risk factor diversified. We know we cannot consistently predict economic or market environments, and we believe that focusing on these two levels of diversification optimizes our potential for more consistent performance.

We produce the following “factor performance quilt” every month to illustrate the potential benefit of adopting a risk factor diversification portfolio construction approach.

In addition to being both asset class and risk factor diversified, all our models have other certain common characteristics, which collectively capture our investment “philosophy”:

- They are global in nature. We are a global firm, and we believe in global diversification.

- They are ETF-focused, which we believe provides us with the best opportunity to optimize both fees and taxes.

- They are “open architecture” and contain both WisdomTree and third-party strategies. We believe this is simply the right thing to do from the end client’s perspective, and it also helps us to optimize our risk factor diversification.

- The factor tilts inherent in most WisdomTree strategies allow us to deploy a “core/satellite” approach (which we call Modern Alpha®), which we believe helps to optimize fees and the potential for alpha generation.

- We charge no strategist fee—our revenue is generated only from the expense ratios associated with the WisdomTree strategies deployed in the different models.

The first half of 2021 has been a perfect example of why we believe risk factor diversification matters and why it is such a core foundation of our portfolio construction approach. To everything (turn, turn, turn)/There is a season (turn, turn, turn)…

You can learn more about the WisdomTree Model Portfolio solution set by visiting our recently launched Model Adoption Center. There you will find complete transparency regarding all our publicly available models—performance, yield, cost, holdings, allocations and so forth. You will also find the results of proprietary research we conducted that helps advisors drive model adoption with their end clients and within their overall practices.

We hope you will give it a look.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy. In providing WisdomTree Model Portfolio information, WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor or end client, and has no responsibility in connection therewith, and is not providing individualized investment advice to any advisor or end client, including based on or tailored to the circumstance of any advisor or end client. The Model Portfolio information is provided “as is,” without warranty of any kind, express or implied. WisdomTree is not responsible for determining the securities to be purchased, held and/or sold for any advisor or end client accounts, nor is WisdomTree responsible for determining the suitability or appropriateness of a Model Portfolio or any securities included therein for any third party, including end clients.

Advisors are solely responsible for making investment recommendations and/or decisions with respect to an end client and should consider the end client’s individual financial circumstances, investment time frame, risk tolerance level and investment goals in determining the appropriateness of a particular investment or strategy, without input from WisdomTree. WisdomTree does not have investment discretion and does not place trade orders for any end client accounts. Information and other marketing materials provided to you by WisdomTree concerning a Model Portfolio—including allocations, performance and other characteristics—may not be indicative of an end client’s actual experience from investing in one or more of the funds included in a Model Portfolio. Using an asset allocation strategy does not ensure a profit or protect against loss, and diversification does not eliminate the risk of experiencing investment losses. There is no assurance that investing in accordance with a Model Portfolio’s allocations will provide positive performance over any period. Any content or information included in or related to a WisdomTree Model Portfolio, including descriptions, allocations, data, fund details and disclosures, are subject to change and may not be altered by an advisor or other third party in any way.

WisdomTree primarily uses WisdomTree Funds in the Model Portfolios unless there is no WisdomTree Fund that is consistent with the desired asset allocation or Model Portfolio strategy. As a result, WisdomTree Model Portfolios are expected to include a substantial portion of WisdomTree Funds notwithstanding that there may be a similar fund with a higher rating, lower fees and expenses, or substantially better performance. Additionally, WisdomTree and its affiliates will indirectly benefit from investments made based on the Model Portfolios through fees paid by the WisdomTree Funds to WisdomTree and its affiliates for advisory, administrative and other services.

Diversification does not eliminate the risk of experiencing investment losses. Using an asset allocation strategy does not assure a profit or protect against loss. Investors should consider their investment time frame, risk tolerance level and investment goals.