Three Reasons Why China Can Roar in 2020

We’re only a few weeks into 2020, but the Chinese equity market has already continued the surge that began late last year. With the thawing of trade tensions between the U.S. and China, culminating in the long-awaited Phase One trade deal being signed earlier this month, investors have become increasingly optimistic amid the global risk-on sentiment.

Chinese equities1 finished 2019 up over 20%, which solidified them as one of the best performing risk assets globally. While that’s certainly an impressive return, what if there was a way that investors could allocate to China more strategically, and potentially eclipse the gains of the broader market?

In 2012, WisdomTree introduced its China ex-State-Owned Enterprises Fund (CXSE), which avoids companies with a significant government influence in favor of those with the liberty to make decisions on behalf of their business and shareholders. Our unique strategy has delivered unique results, returning over 36% (on a NAV basis) last year and beating the broader Chinese market by about 13%. For standardized performance of CXSE, please click here.

We believe that China may continue to surge even higher this year for a few different reasons.

Reason #1: Addition via Subtraction

CXSE avoids companies where the government is a significant shareholder, whose interests may not align with that of the business or other common shareholders. Classified as companies where the government owns at least 20% of shares outstanding, state-owned enterprises (SOEs) make up about 40% of the Chinese market (represented by the MSCI China Index) but have little to show for their prominence.

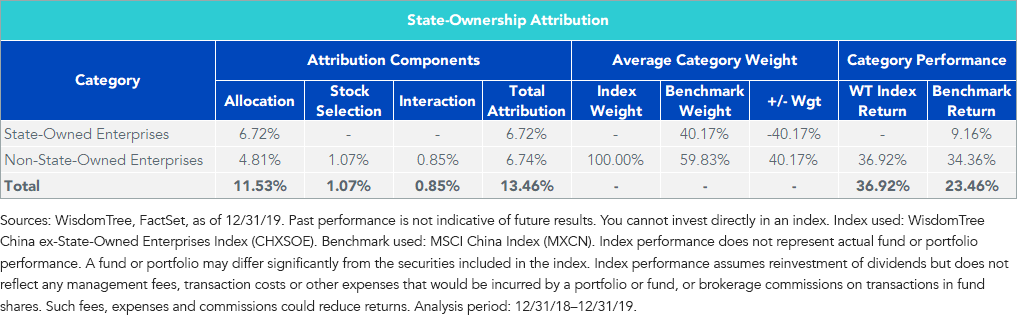

If we compare the performance of the WisdomTree China ex-State-Owned Enterprises Index (the index that CXSE seeks to track2) versus the MSCI China Index, we see that WisdomTree’s rejection of SOEs is responsible for half of the 13% excess return generated in 2019. The other half came from reallocating into non-SOEs, or companies that are able to make decisions aligned with shareholder interests and business objectives.

Figure 1: State-Ownership Performance Attribution

Reason #2: Targeting the Right Sectors

The second reason is a byproduct of the first. By avoiding SOEs, our exposures are titled away from the government-influenced fixtures of the economy, such as banks, energy and utility companies, in favor of consumer-driven and growth-oriented businesses, like information technology.

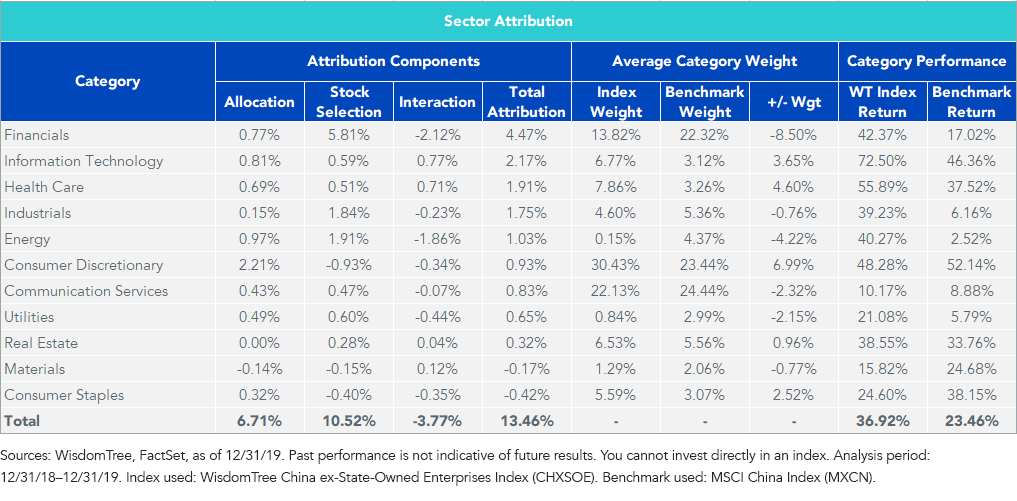

During 2019, we had an average underweight of about 15% to banks, energy companies and utilities, which, along with the non-SOEs within them, contributed about half of the year’s excess return. By contrast, our average 15% overweight to information technology, health care and consumer discretionary contributed about 5%, driven by the larger allocation in these non-SOE-heavy sectors.

Figure 2: Sector Performance Attribution

Reason #3: Avoiding SOEs Targets Efficient Companies

Our third reason is attributable to our non-SOE mandate once again. We only allocate to companies that are free from the government’s interests as a shareholder, which means leaders and directors are able to pursue business objectives, such as cutting costs, increasing revenues and other endeavors. That results in a collection of companies with robust operations and financial health.

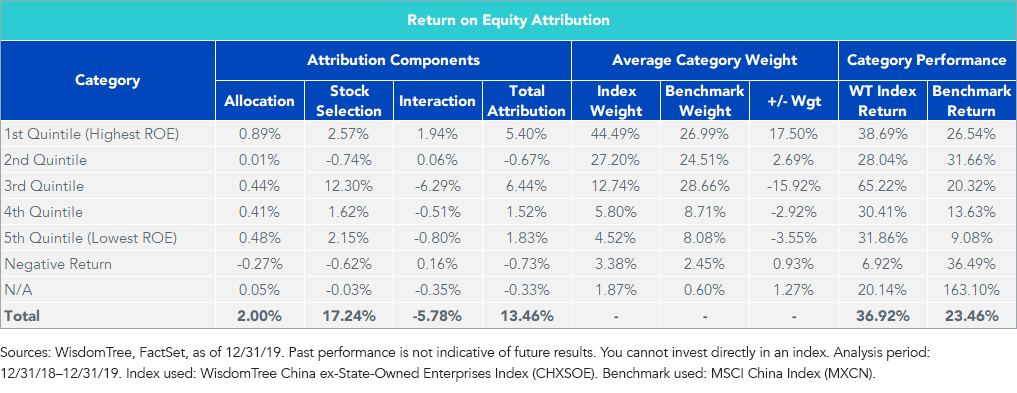

If we compare last year’s returns by return-on-equity (ROE) quintiles, we see that performance was driven by companies with the highest ROE quintile (which had an 18% overweight), while underweighting those with the lowest ROE. In many cases, the underlying methodology invested in the companies that performed the best within the lower ROE quintiles as well, which aided performance further.

Figure 3: ROE Quintile Performance Attribution

Will China Climb Higher in 2020?

While past performance is not indicative of future results, we do think that unique performance is indicative of a unique strategy. For investors considering where China fits into their asset allocation, we think the WisdomTree China ex-State-Owned Enterprises Fund (CXSE) is a compelling offering with a track record of success.

Unless otherwise stated, data sources are WisdomTree and FactSet, as of 12/31/2019.

1Universe used: MSCI China Index (MXCN)

2CXSE seeks to track the price and yield of the WisdomTree China ex-State-Owned Enterprises Index before fees and expenses

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in China, including A-shares, which include the risk of the Stock Connect program, thereby increasing the impact of events and developments associated with the region which can adversely affect performance. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. The Fund’s exposure to certain sectors may increase its vulnerability to any single economic or regulatory development related to such sector. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.