Screening for Bad Apples in Your Bond Basket

The impact of COVID-19 reared its ugly head over the last couple of weeks in the U.S. corporate bond market. Certainly the twin effects of the virus and the plunge in crude oil prices resulted in credit spreads widening out in a rather visible fashion, especially in more recent trading sessions. With the markets sometimes fluctuating wildly on a daily basis, it is of little use to quote actual numbers (they get stale rather quickly). However, what has been underscored of late is that investors are encouraged to adopt a strategy that helps screen for quality.

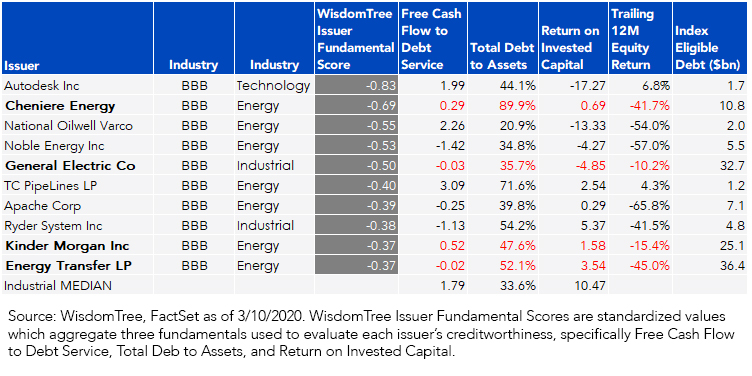

Here at WisdomTree, our approach emphasizes the potential to avoid “fallen angel candidates” (investment-grade issuers that are downgraded to high yield) by focusing on the fundamentals. The WisdomTree Issuer Fundamental Scores effectively quantify the balance sheet strength of corporate bond issuers. Without a strong balance sheet, companies may have difficulty servicing their debt and ultimately end up getting downgraded to junk status. We use three metrics to screen our universe of investment-grade corporate bonds: free cash flow to debt service, total debt to assets and return on invested capital. We remove those which screen poorly on these fundamentals.

Find below the issuers who scored worst using our fundamental scores within the Industrials sector, the most broad sector classification provided by Bloomberg Barclays, excluding Financial and Utilitity issuers.

Worst 10 Industrial Issuers by WisdomTree Corporate Fundamental Score as of 3/10/2020

In our last quarterly rebalance at the end of February, we identified a handful of relatively sizable issuers that scored poorly using issuer fundamentals: Cheniere Energy, General Electric, Kinder Morgan and Energy Transfer. Overall leverage levels for these companies are noticably higher than comparable investment-grade issuers. Similarly, they also screen low for their ability to generate free cash flow relative to their debt service liabilities. Equity returns for these issuers over the past year are mixed, but we don’t find it particularly surprising that many of them have sold off more than 40%.

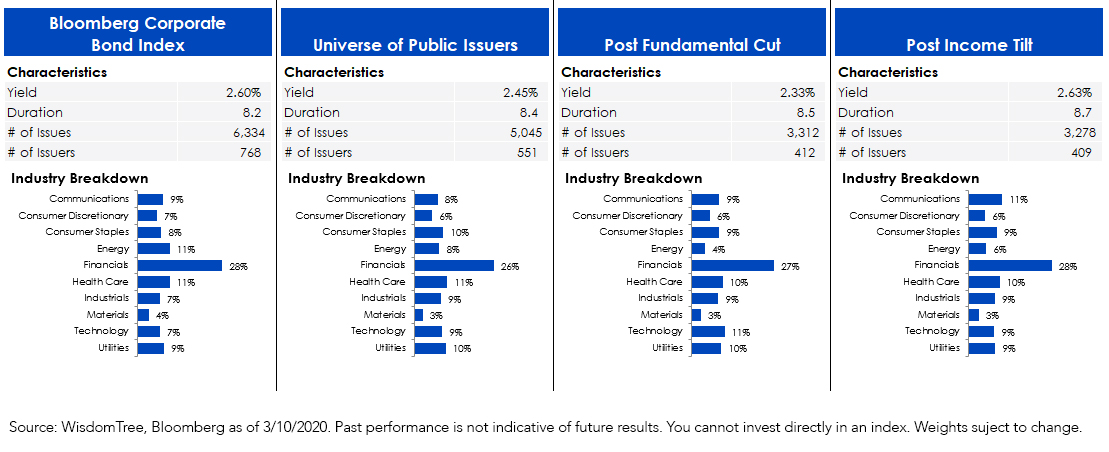

In an effort to address these concerns about issuer fundamentals, the WisdomTree U.S. Corporate Bond Index (WFCIG) was designed to provide an alternative to blindly allocating across the credit spectrum. It offers an intuitive approach, seeking to identify debt issues with quality fundamentals and attractive income profiles. The table below illustrates the construction of WFCIG, how the Index is impacted by removing the bottom 20% of issuers with poor fundamentals, and how we believe weighting bonds by our income score boosted the yield profile of the Index.

Conclusion

At the end of the day, we believe investors want their investment-grade portfolio to stay investment grade. The WisdomTree U.S. Corporate Bond Fund (WFIG), which is designed to track the aforementioned WFCIG, offers investors the potential to avoid the pittfalls of corporate bond investing that seem to be getting highlighted on a daily basis in the current environment.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. While the Fund attempts to limit credit and counterparty exposure, the value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of the Fund’s portfolio investments. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.