Dividend Stability: History as a Guide

As fear spreads throughout the markets, it pays to step back and think about what drives long-term stock returns.

What matters most?

The underlying cash flow of businesses and the cash they return to shareholders—which comes in the form of dividends!

Yes, some dividends will be cut in the upcoming downturn. The market is pricing that in. Many large-cap energy stocks have dividend yields around four times the average dividend yield in the market, indicating these yields are highly suspect.

Just yesterday, Ford became the most notable company to announce a suspension of their quarterly dividend.

But how much might overall market dividends get cut this year?

Let’s let history be our guide.

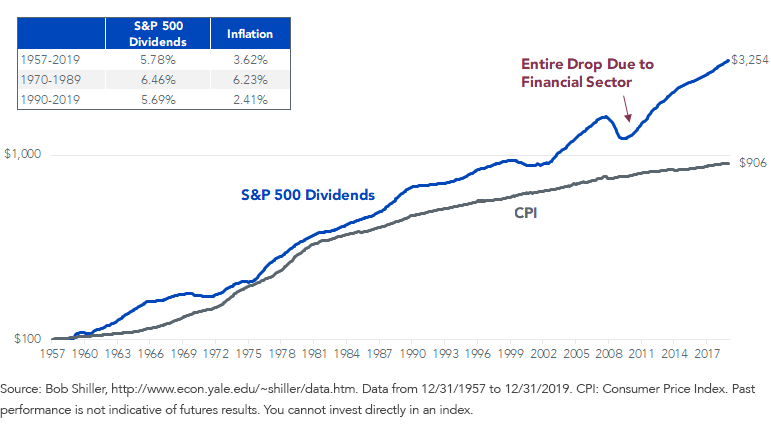

The S&P 500 was born as an index of 500 stocks in 1957. Since then, dividends have grown by an average of 5.8% per year—more than 2% above the rate of inflation.

That characteristic is why Professor Jeremy Siegel refers to stocks as “Super TIPS”— TIPS being the ultimate inflation-adjusted treasury security. Stocks can provide long-term inflation protection, but with real growth to boot.

This was true during high inflation periods (the ’70s and ’80s), when inflation averaged more than 6%. It’s also been true during low-inflation periods, such as the last three decades, when inflation averaged less than 2.5% per year while dividend growth was still around 5.7%.

Dividend Growth Rate Beats Inflation

A few things stand out about long-term dividend growth.

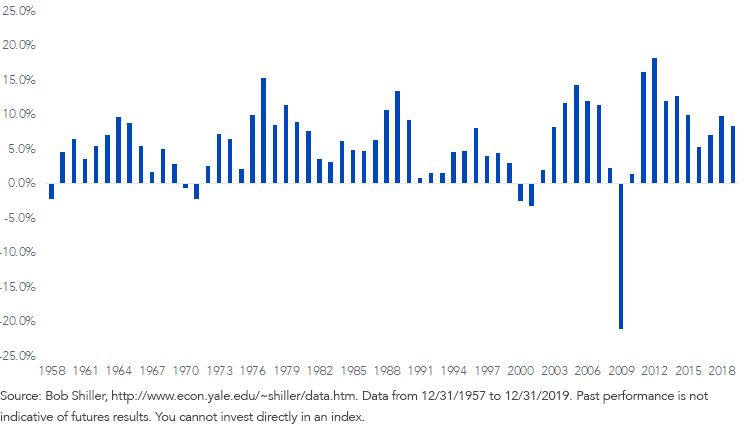

In the last 62 years, there were only six years where dividend levels declined, and only one where they fell more than 5%.

By contrast, during those same 62 years, stock prices fell in 18 years, with a worst calendar-year decline of over 40% and an average decline of more than 11%.

Stock prices were three times more volatile than their underlying dividend cash flows, as sentiment drives short-term prices more than the cash flow volatility, which drives long-term value.1

Annual Dividend Growth on S&P 500 Index

The S&P 500 was recently down nearly 30% from its previous high. Daily market price moves between 7% and 10% have been common.

But what are the odds of dividends falling 20% this year, like they did in 2009?

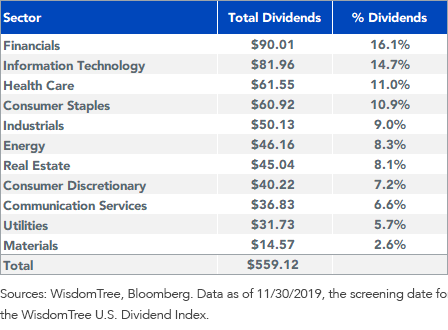

The Dividend Stream® today is much more diversified than it was in 2009, when over 30% of all dividends came from the financial sector. Today, Financials, the largest dividend-paying sector, represent just 16% of all dividends paid.

The next three largest sectors—Technology, Health Care and Consumer Staples—tend to be more immune against dividend cuts and likely three sectors with growth this year.

If aggregate dividends were to decline like they did in ’09, it is also important to remember that it took only 4 years before dividend levels reached new highs after the global financial crisis.

Market prices often move much more than the fundamentals of businesses. Long-term investors should come back to focusing on underlying cash flows from owning equities many years into the future.

Dividends—which drive long-term stock values—are more robust and stable than the wild swings we have seen recently.

1Based on the standard deviation of annual dividend changes and price changes on the S&P 500.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.