International Quality Dividend Growth—2020 Reconstitution

Earlier this month, WisdomTree conducted its annual reconstitution for all developed international dividend indexes—broad dividends, high dividends and quality dividend growth.

In this post, we will provide a review of the reconstitution of the WisdomTree International Quality Dividend Growth Index.

Country and Sector Changes

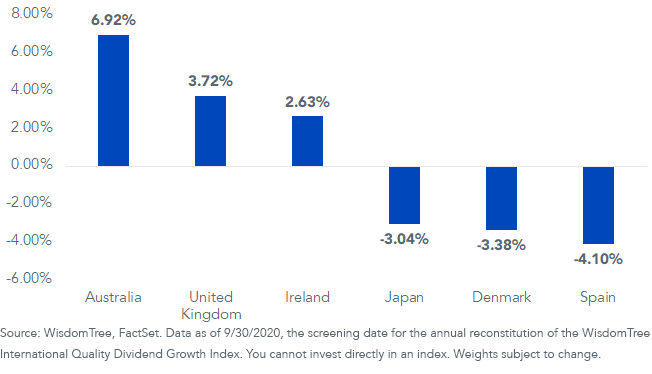

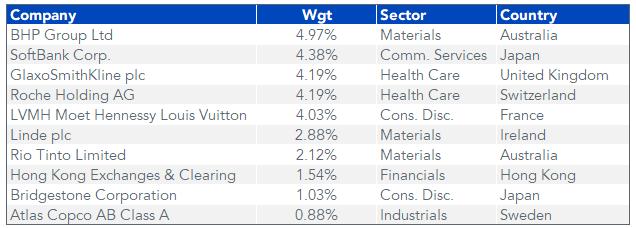

The biggest single change from a country perspective was Australia, with an increase of 7%. This increase is driven by the addition of two Australian mining companies—BHP Group (4.97% weight) and Rio Tinto Limited (2.12%).

BHP and Rio Tinto are the two largest metals and mining companies in the world. Both have low levels of financial leverage and steady earnings and have benefited from a significant increase in the price of iron ore this year. BHP generates about 40% of its revenue from iron ore; Rio Tinto more than 50%.1

The United Kingdom had the second largest increase, largely attributed to the addition of the pharmaceutical company GlaxoSmithKline (GSK)—a 4.19% weight.

Top 3 Pre-Rebalance and Post-Rebalance Country Weight Changes

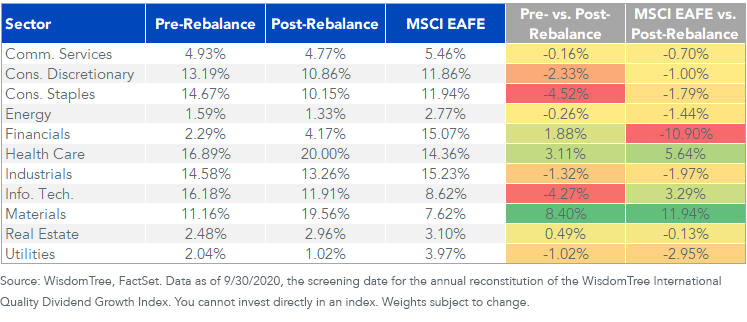

When looking at sector changes, Materials had the biggest percentage weight increase, driven by the two Australian companies as well as Linde, an Ireland-incorporated materials company.

The reduction from Information Technology was primarily driven by the Dividend Stream® weighting process that tends to reduce weight to the sectors that had the greatest price appreciation.

Two noteworthy removals from Consumer Staples were British American Tobacco (3.64%) and Diageo (1.82%).

Overall, the largest sector weight remains Health Care, which is a 5.6% over-weight relative to the MSCI EAFE Index. The weight to Financials increased slightly, but its almost 11% under-weight is the greatest of any sector relative to MSCI EAFE.

Aggregate Sectors

Single Company Changes

The tables below provide additional detail on the largest additions and drops from the Index.

Of the top 10 drops, only Evraz plc (0.69% weight) was removed based on new enhanced risk screening that was introduced at this rebalance.

WisdomTree’s quality dividend growth Indexes were designed for dividend sustainability and a growth emphasis. Because constituents are selected based on quality and estimated earnings growth, there is only a modest impact to our quality Indexes from these new risk screens.

Top 10 Additions

Top 10 Drops

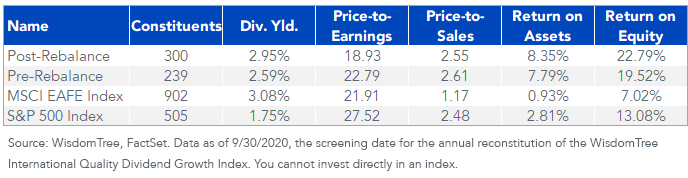

Post-rebalance fundamentals show reduced valuations—the process of giving greater weight to higher dividend payers rather than price performance applies a valuation discipline—and an increase in quality metrics.

Return on assets (ROA) improves from 7.79% to 8.35%, and return on equity (ROE) improves more than 300 basis points (bps) from 19.52% to 22.79%.

While the discounted valuations of MSCI EAFE relative to the S&P 500 can be explained by significantly lower profitability, the quality dividend growth Index has a lower earnings multiple with higher profitability relative to the S&P 500.

Fundamentals: Pre-Rebalance and Post-Rebalance

Factor Tilts

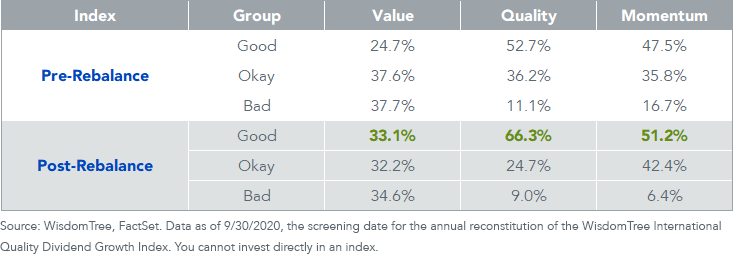

Another way of illustrating the changes to quality and value on the pre-rebalance Index and post-rebalance Index is with WisdomTree’s multifactor scorecard.

By design, each category—good, okay and bad—contains roughly a third (33%) of the total market cap of developed international equities. Tilts away from the market across these categories indicate how an Index taps into these different factors.

Using a composite measure of six ratios for value, the Index increased exposure to the good value stocks from about 25% to about 33%. This indicates a similar weight to good value as a market cap-weighted benchmark.

An even more significant increase can be seen from quality, where the Index improves from about 53% weight in good quality to more than 66%.

Momentum—which is part of the composite risk screening process but not a direct factor used in selecting or weight—also shows a modest increase in exposure to good momentum companies.

Factor Tilts: Pre-Rebalance and Post-Rebalance

While many investors argue that market cap-weighted developed international indexes hold implicit bets on the outperformance of value—and more specifically, banks—the WisdomTree International Quality Dividend Growth Index was designed to have a more balanced factor profile. And with the outperformance of quality during this year’s downturn, this Index has outperformed the MSCI EAFE Index by nearly 1,000 bps year-to-date.2

1“Big Global Miners: NPV at risk: Iron ore stocks stand out,” Bank of America Global Research, 10/15/20.

2Source: WisdomTree, FactSet. Net total returns from 12/31/19-10/30/20.