Complementing an Efficient Core Strategy with Managed Futures

A traditional 60/40 portfolio aims to provide investors with exposure to equities with downside mitigation through an allocation to Treasuries.

Historically, the practice of incorporating additional Treasury exposure to help hedge an equity portfolio has worked well, due to correlations between Treasuries and the S&P 500 Index being low or negative most of the time. This is a critical factor in the performance of a traditional 60/40 portfolio.

More recently, with fears of inflation looming, Treasury yields near all-time lows and equity valuations stretched, fleeting moments of equity downturns coupled with rising rates give cause for a valid concern: What is the best way to hedge a portfolio?

We’ve made the case for the efficient use of capital through a leveraged 60/40 portfolio, building on the seminal research of Cliff Asness.

A leveraged 60/40 portfolio, combined with an alternative asset class such as managed futures, can allow investors to deploy their capital more efficiently than with traditional asset allocation.

The Challenges of Adding Alternatives to a Traditional 60/40 Portfolio

Historically, incorporating alternative strategies such as a managed futures fund into a traditional 60/40 portfolio has come at the cost of lowered absolute performance. While adding an uncorrelated asset class can reduce volatility and drawdowns, absolute returns tend to be negatively impacted. With rates near all-time lows, adding an alternative asset class has become attractive for both diversification and return potential.

Of particular interest is the correlation between a traditional 60/40 portfolio and the BarclayHedge U.S. Managed Futures Industry BTOP50 Index (Managed Futures Index), which seeks to replicate the managed futures asset class focusing on trading style and overall market exposure. A managed futures strategy will invest in a variety of asset classes like commodities, currencies, treasuries and equities using futures contracts and, in some cases, will employ long/short strategies.

Due to the diverse set of risk factors, the resulting strategy tends to have significantly reduced correlation to the components of a traditional 60/40 portfolio.

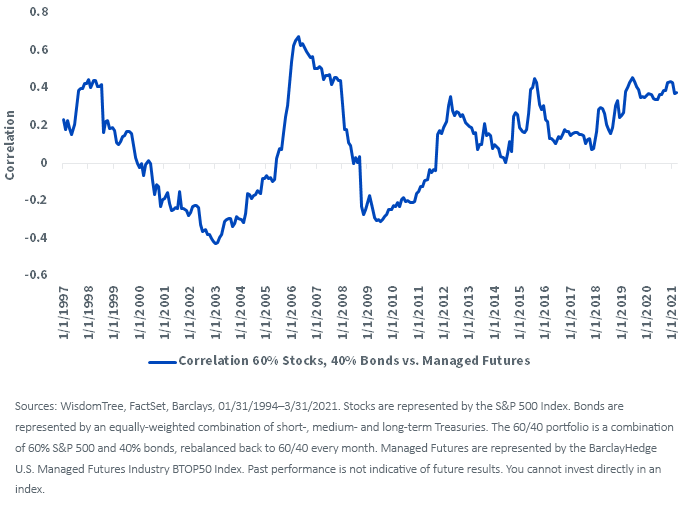

A lower correlation between portfolio components implies that the volatility of the combined allocation should be lower than its parts. As shown in the figure below, the trailing correlation between a 60/40 portfolio and the Managed Futures Index has been weak, and at times negative. Throughout the entire period, the average 36-month correlation was approximately 0.1.

Trailing 36-Month Correlation

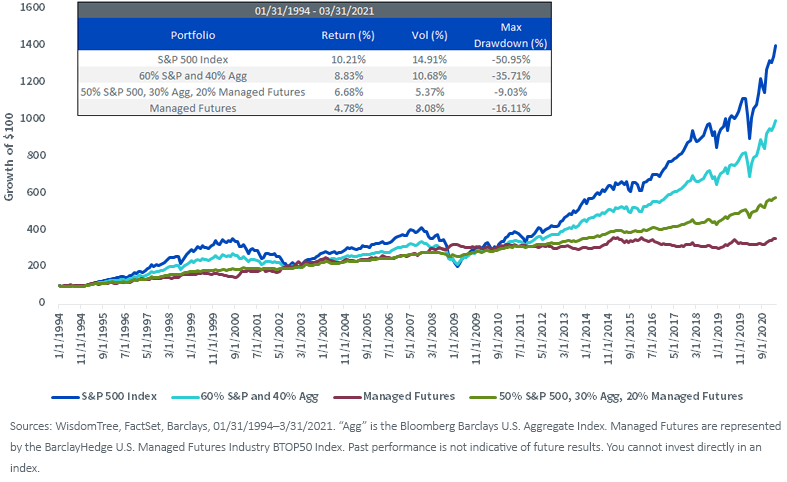

In the chart below we compare the performance of a traditional 60/40 portfolio—comprising a 60% investment in the S&P 500 Index and a 40% investment in the Bloomberg Barclays U.S. Aggregate Index (Agg)—to a portfolio that allocates 50% in the S&P 500, 30% in the Agg and 20% in the Managed Futures Index.

We can see a substantial volatility reduction by incorporating the managed futures proxy compared to the 60/40 portfolio. But what is particularly interesting is the significant reduction in downside risk. While the diversified 60/40 helped reduce the downside risk compared to an all-equity portfolio, incorporating the Managed Futures Index reduced the portfolio’s maximum drawdown further to approximately 9%.

Improving Capital Efficiency while Seeking Diversification

Using WisdomTree’s Efficient Core strategies—which employ accounting leverage on a traditional 60/40 allocation to gain a 90/60 exposure (1.5 times)—an investor can achieve their objective 60/40 allocation using only two-thirds of their capital. This frees up one-third of an investor’s capital to pursue uncorrelated returns in a more efficient manner.

We have observed the risk mitigation benefits of incorporating an alternative strategy such as managed futures to a traditional 60/40 allocation, and we can extend this application using WisdomTree’s Efficient Core strategies. In the chart below we can see how a portfolio that combines a leveraged 60/40 allocation with the Managed Futures Index stays within the capital market line (CML) and improves the absolute return of the traditional 60/40 strategy without giving up any risk-adjusted return. The resulting portfolio provides returns that historically have been very similar to that of the S&P 500, at substantially reduced volatility.

Risk vs. Return (1/31/1994–3/31/2021)

Conclusion

The benefits of additional diversification through alternative strategies are well understood. Historically, the addition of these types of funds has been difficult to justify due to low absolute returns, and the lack of a need for an additional hedge. However, inflation concerns combined with low rates presents a potential opportunity to boost returns using efficient capital strategies while adding diversification through alternative strategies, with managed futures being an excellent example of such an alternative strategy.

Important Risks Related to this Article

While the Funds are actively managed, their investment processes are expected to be heavily dependent on quantitative models and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Funds invest in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Funds’ use of derivatives will give rise to leverage. Derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Funds may change quickly and without warning and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.

Matt Aydemir began his career at WisdomTree as a Research Analyst in January 2020. He is responsible for quantitative research on WisdomTree’s products, as well as the maintenance and reconstitution of WisdomTree’s indexes. Prior to joining WisdomTree full-time, Matt worked in the research team as an intern, where he developed tools for portfolio analytics. Matt received his Master’s in Financial Engineering degree from Columbia University in 2020, and his Bachelor’s in Chemical Engineering degree from the University of Waterloo in 2016.