Growth via ex-State-Owned China

The universe of Chinese stocks that excludes state-owned enterprises—a basket with a technology- and consumer-oriented focus—has been among the best performers over the last three years within the emerging market universe.

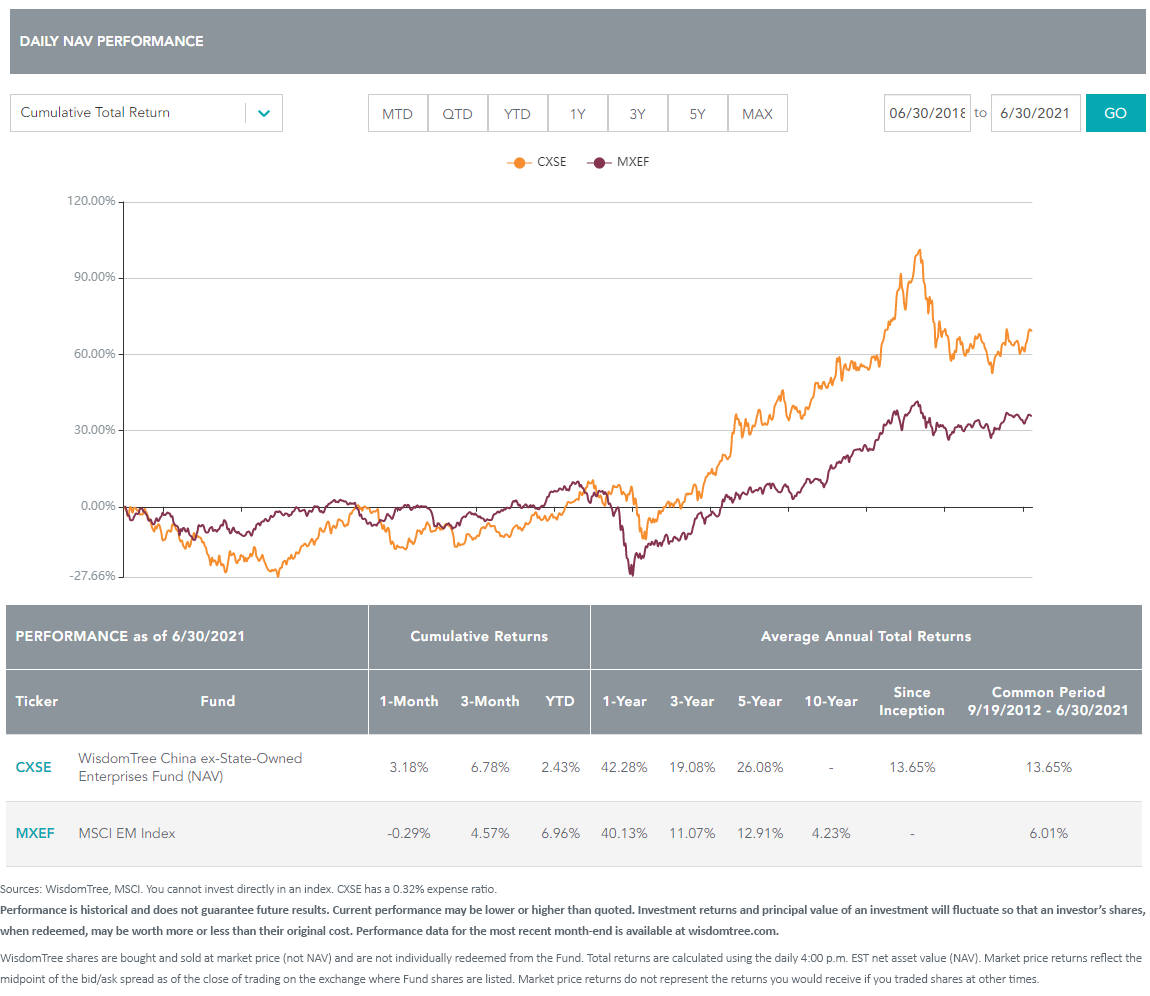

We can see this trend in the performance of the WisdomTree China ex-State-Owned Enterprises Fund (CXSE) versus the broader MSCI Emerging Markets Index (MXEF).

2020 was particularly strong for China’s diverse tech-oriented, non-state-owned businesses. The table below illustrates a cross-section of some of the biggest and fastest growing of these companies.

2020 was particularly strong for China’s diverse tech-oriented, non-state-owned businesses. The table below illustrates a cross-section of some of the biggest and fastest growing of these companies.

Only Xiaomi operates in a traditional technology hardware business. Others are leaders in e-commerce (Alibaba, Pinduoduo, Meituan, JD.com), streaming services/social media/video games (Baidu, Tencent, NetEase) and online education programs (New Oriental, TAL Education).

As with tech-enabled companies in the U.S.—names like Amazon, Netflix and DoorDash—the pandemic accelerated the positive network effects and scalability for many of these businesses when their products/platforms became nearly essential utilities during lockdowns.

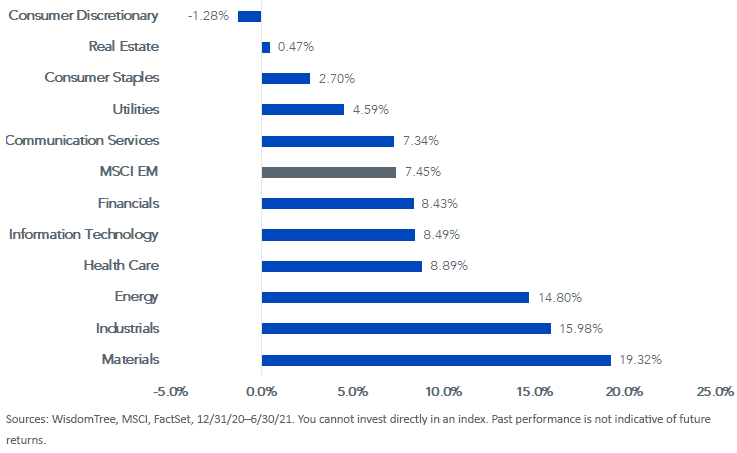

As the global factor rotation away from growth stocks and toward value stocks took hold in the first half of 2021—and Chinese regulators made clear their intentions to limit some of the unfettered growth of its tech and consumer champions—China tech/consumer companies underperformed more cyclical and value names in commodity sectors and countries.

Year-to-Date MSCI EM Sector Returns

Rather than China, which is heavily tilted toward the dominant tech and consumer companies in the emerging markets, Russia, South Africa and Mexico have led this year.

As we get to mid-year readjustments, some investors are repositioning portfolios away from just the cyclical value rotation toward tech and growth—and we can see CXSE benefiting from that return to growth allocations.

We recently saw a large institutional investor swap $100 million from a broad MSCI China tracking product to CXSE for their China exposure—and we think it is useful to review the arguments for why the non-SOE approach for China is compelling.

SOE Drivers of Performance

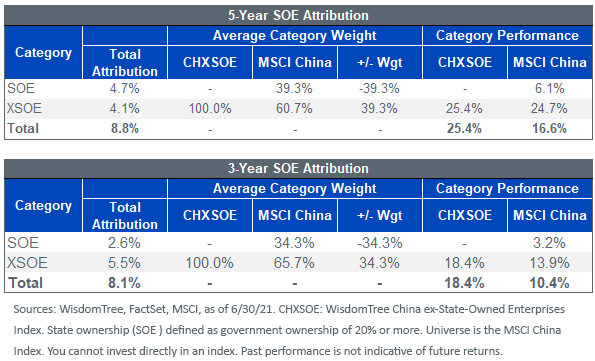

Using our attribution tools, we can see the drivers of performance of the WisdomTree China ex-State-Owned Enterprises Index (CHXSOE) versus the MSCI China Index. State ownership has been a large factor driving returns over the last three and five years, as the WisdomTree Index benefited from allocating less to the lower-returning SOEs over these periods.

China State-Ownership Attribution

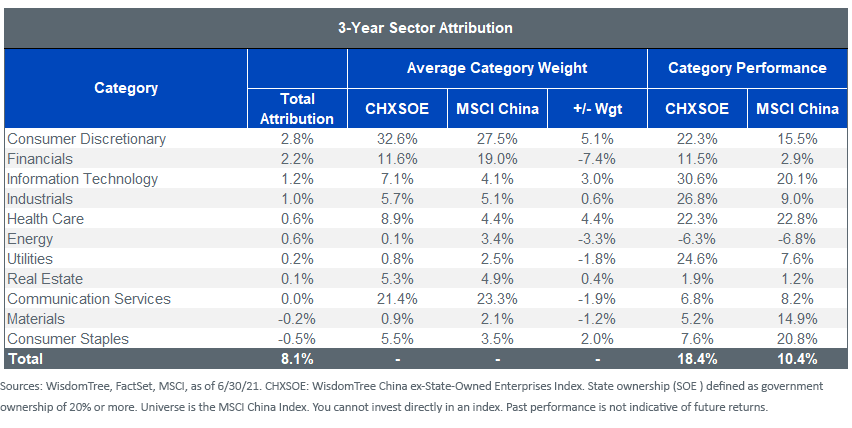

One of the natural questions that comes up is how much of the SOE factor performance is a sector allocation story. Notably, 8 of the 11 sectors had a positive contribution to relative Index performance over the last three years—with Consumer Discretionary and Financials having the two largest impacts.

But while over-weights to Consumer Discretionary (by five points) and under-weights to Financials (by 7.4 points) helped, stock selection was also a significant driver. The Consumer Discretionary and Financials stocks that were included performed better than those in the benchmark.

Conclusion

The pockets of the market most sensitive to global economic conditions—Materials, Energy, Financials, Industrials—rallied in the first few months of the year in anticipation of continued reopening of the global economy.

As the narrative shifts from a “reopening trade” to how to build portfolio allocations toward long-term winners, more investors may want to consider the opportunity set of non-state-owned Chinese companies—a universe that includes many tech and consumer businesses that only seemed to bolster their economic moats over the past year.

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in China, including A-shares, which include the risk of the Stock Connect program, thereby increasing the impact of events and developments associated with the region that can adversely affect performance. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. The Fund’s exposure to certain sectors may increase its vulnerability to any single economic or regulatory development related to such sector. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.