And Now for Something Completely Different

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these Model Portfolios.

“And Now for Something Completely Different”

(Tagline from the iconic sketch comedy show, “Monty Python’s Flying Circus,” which aired 1969–1974 on the BBC)

We recently published a blog post about NTSX , our innovative “90/60 Efficient Core” strategy that combines U.S. equities and U.S. Treasury futures contracts to provide a capital-efficient exposure to the traditional 60/40 stock/bond portfolio.

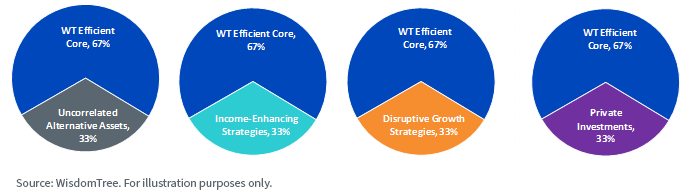

Put simply, if you have $100 to invest, you can invest $67 of that into NTSX and have the equivalent exposure to $100-worth of an S&P 500/Treasury portfolio, leaving you with $33 left to explore more alpha-seeking, yield-seeking or diversifying exposures within your overall portfolio.

NTSX just passed its three-year live track record anniversary. We also recently launched developed international (NTSI) and emerging markets (NTSE) Emerging Markets versions of NTSX.

How the Efficient Core Strategies Are Constructed

- Equity Component: $90 invested in equity exposure for every $100 invested in the ETF.

- WisdomTree U.S. Efficient Core Fund (NTSX): The equity component is a portfolio of 500 large-cap U.S. stocks, weighted by market capitalization to provide broad exposure to U.S. equities.

- WisdomTree International Efficient Core Fund (NTSI): The equity component is a portfolio of 500 large-cap international stocks, weighted by market capitalization to provide broad exposure to international equities.

- WisdomTree Emerging Markets Efficient Core Fund (NTSE): The equity component is a portfolio of 500 large-cap emerging markets stocks, weighted by market capitalization to provide broad exposure to emerging markets equities.

- Cash Component: For every $100 invested in the ETF, $10 is kept in short-term collateral that earns returns comparable to U.S. Treasury bills.

- Bond Futures Ladder: To help magnify the benefits of the asset allocation, $60 of bond futures is overlaid on top of the $90 of equity exposure and $10 of cash collateral.

- Treasury futures are laddered (equal-weighted) across the 2- , 5- , 10- and 30-year segments of the yield curve to diversify interest rate risk.

- The average effective duration for the fixed income portion of NTSX will typically be 7–7.5 years and is generally meant to offer the duration profile of traditional aggregate bond indexes.

- Average effective duration for the fixed income portion of NTSI and NTSE will typically be 3–8 years and is generally meant to offer the duration profile of traditional aggregate bond indexes.

So, What Can Advisors Do with the Extra Cash?

The opportunities for allocating the extra money freed up by starting with an efficient core portfolio (which could be individual ETFs for regionally specific portfolios or combined to form an efficient global core portfolio), are almost limitless, driven by specific investor or advisor mandates or objectives.

Here are a few examples:

- Uncorrelated alternative assets to reduce volatility and/or add in additional potential source of return: Strategies might include managed futures, long/short equity, global macro, diversified arbitrage, volatility dampening or real assets. WisdomTree strategies that might fit here are our managed futures Fund (WTMF) and our broad-basket commodities Fund (GCC).

- Income-enhancing strategies to boost incremental yield on top of an equivalent 100% 60/40 portfolio: Strategies might include high yield bonds, preferred stocks, emerging markets debt, MLPs, REITs and alternative credit. WisdomTree strategies that might fit here include our high-yield Fund (WFHY), our interest rate hedged high-yield Fund (HYZD), our emerging markets local debt Fund (ELD), our emerging markets (U.S. dollar-based) corporate bond Fund (EMCB) and our alternative credit income Fund (HYIN).

- Maximum growth satellites to allocate to longer-term thematic and high-growth industries, sectors and firms: These thematic industries might include cloud computing, genomics, cybersecurity, fintech, online gaming/e-sports, etc. Advisors interested in this angle may want to explore the WisdomTree Disruptive Growth Model.

- Private investments for longer-term growth allocations: These strategies might include hedge funds, private equity, private credit and private real estate. While these types of illiquid, long-time horizon investments historically have been the domain of “qualified purchasers” (QPs) such as ultra-high net worth families and family offices, endowments, pension funds and sovereign funds, there has been a dramatic evolution toward “democratizing” them and making them available (in more liquid structures, such as interval funds and registered investment companies, or “RICs”) to accredited investors (AIs), which have lower required net worth and/or income requirements.1

Conclusions

There are, of course, many other ways to allocate the additional capital. More risk-averse investors, or investors who require substantial liquidity from their investment portfolios, might allocate to cash, money markets or short-term bond investments. Investors seeking inflation protection might allocate to gold, precious metals or broad-basket commodities. Investors seeking out-of-the-mainstream allocations might consider cryptocurrencies, NFTs (non-fungible tokens), collectibles, artwork, fine wines, etc.

The primary point is the use of the WisdomTree Efficient Core strategies opens up possibilities for advisors and investors to build truly customized portfolios in a highly capital efficient manner, without sacrificing an underlying allocation to a traditional stock/bond portfolio.

We believe this way of thinking about portfolio construction is potentially game changing and “something completely different.”

Your WisdomTree representative would be delighted to discuss these ideas in greater detail.

1 A “qualified purchaser” or “QP” is an individual or family that owns $5 million or more in liquid net worth. Other variations of QPs include (a) an individual or entity (for example, a fund manager) that invests at least $25 million in private capital, on its own account or on behalf of other qualified purchasers; (b) a trust sponsored and managed by qualified purchasers; (c) or an entity owned entirely by qualified purchasers. An “accredited investor” is an individual or family that meets one of two criteria: (a) has an adjusted net income of greater than $200,000 for each of the previous two tax years, or (b) has a net worth (excluding primary residences and debts) of more than $1 million.

Important Risks Related to this Article

WisdomTree Model Portfolio information is designed to be used by financial advisors solely as an educational resource, along with other potential resources advisors may consider, in providing services to their end clients. WisdomTree’s Model Portfolios and related content are for information only and are not intended to provide, and should not be relied on for, tax, legal, accounting, investment or financial planning advice by WisdomTree, nor should any WisdomTree Model Portfolio information be considered or relied upon as investment advice or as a recommendation from WisdomTree, including regarding the use or suitability of any WisdomTree Model Portfolio, any particular security or any particular strategy.

There are risks associated with investing, including the possible loss of principal.

NTSX: While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness.

NTSI: Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness. Diversification does not eliminate the risk of experiencing investment losses.

NTSE: Investments in non-U.S. securities involve political, regulatory and economic risks that may not be present in U.S. securities. For example, foreign securities may be subject to risk of loss due to foreign currency fluctuations, political or economic instability, or geographic events that adversely impact issuers of foreign securities. Investments in securities and instruments traded in developing or emerging markets, or that provide exposure to such securities or markets, can involve additional risks relating to political, economic or regulatory conditions not associated with investments in U.S. securities and instruments or investments in more developed international markets. While the Fund is actively managed, the Fund’s investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. The Fund invests in derivatives to gain exposure to U.S. Treasuries. The return on a derivative instrument may not correlate with the return of its underlying reference asset. The Fund’s use of derivatives will give rise to leverage and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning and you may lose money. Interest rate risk is the risk that fixed income securities, and financial instruments related to fixed income securities, will decline in value because of an increase in interest rates and changes to other factors, such as perception of an issuer’s creditworthiness. Diversification does not eliminate the risk of experiencing investment losses.

Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

Morningstar: The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10- year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

© [2021] Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.