Introducing WisdomTree's Target Range Fund

2020 reminded us that volatility and unpredictability can emerge when least expected. Now, as uncertainty lingers and interest rates remain near historic lows, many investors are seeking ways to pursue their long-term goals while also attempting to reduce risk. WisdomTree believes a new strategy can help investors achieve long-run portfolio objectives while seeking to dampen investment losses.

The WisdomTree Target Range Fund (GTR) is an actively managed exchange-traded fund that seeks to provide capital appreciation, with a secondary objective of hedging risk. In general, the Fund is expected to provide similar exposures to the TOPS® Global Equity Target Range Index (TOPSGB) (the “Index”), a systematic strategy that buys call options that are 15% in-the-money and sells call options that are 15% out-the-money, but it will not match the Index’s returns due to the amount and timing of assets that flow in and out of the Fund1. TOPSGB was created by Valmark Advisers, a subsidiary of Valmark Financial Group.

What Are Target Range Strategies?

Target range strategies offer a new approach to risk management by providing the potential to participate in the growth of equity markets with limited downside protection over the course of an annual period*.

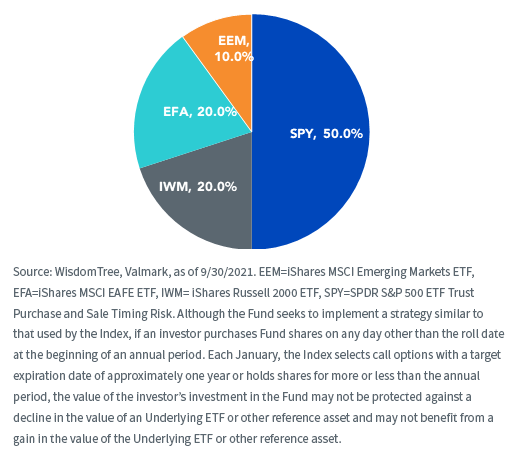

The WisdomTree Target Range strategy offers exposure to a diversified portfolio of global equity ETFs, representing the U.S. large-cap and small-cap segments of the market, as well as developed and emerging markets. Specifically, the Fund purchases options on ETFs with the following targets:

How Do Target Range Strategies Work?

The WisdomTree approach involves purchasing one-year call options on each underlying ETF at the start of the year that are 15% in-the-money and selling one-year call options that are 15% out-of-the money—while the remainder of the Fund is allocated to a collateral account invested in fixed income instruments. Assuming the options cost 15 cents to acquire these 15% in-the-money options, approximately 85 cents of every dollar invested in the Fund is in the collateral account.

If markets decline, the potential target loss would be the amount of capital invested in the call options, minus any proceeds received from selling options to offset the cost2.

Restrike Event & Re-set the Target Range

If on the last business day of the month, the price of the underlying ETF appreciates and is above the strike price of existing short call option, the Fund will enter into new options contracts to ratchet up the upside and the corresponding loss range. We believe this allows investors to stay allocated to one single target range product and improves ease of implementation.

To help reduce costs, the Fund sells higher strike call options. This is done on a per exposure basis, i.e. for each of the four ETFs held in the portfolio.

Why Should I Use a Target Range Strategy?

With target range strategies, investors can have the knowledge they have downside risk targets by attempting to reduce the maximum possible loss of their investments. Target range strategies can also limit adverse volatility; while there are no guarantees, by design, target range strategies have historically proven effective at managing spikes in volatility vs. equity markets. When markets sold off during the Global Financial Crisis (2008) and COVID-19 pandemic (2020), target range strategies lowered volatility and drawdowns vs. long-only approaches3.

How Can Target Range Strategies Fit into a Portfolio?

We believe target range strategies offer a compelling alternative to traditional approaches to better tailor the risk and reward balance for investors’ needs. Designed for limited downside risk protection with the potential to participate in market gains , target range strategies can be used widely to:

Help de-risk equity positions – the current environment is filled with uncertainty. Equity markets are near all-time highs despite a cloudy outlook in earnings. Swapping traditional unhedged equity positions for a target range strategy may reduce a portfolio’s overall risk and avoid significant drawdowns.

Diversify traditional asset allocation – with yields being historically low, we believe traditional fixed income vehicles can no longer satisfy investors’ needs for income. Taking more equity risk – but in a strategy that seeks to control risk–can help investors embrace lower fixed income allocations while attempting to keep overall portfolio risk lower.

Sequence of return risk – for retirees and investors who need flexibility in withdrawing funds, sequence of returns risk is huge. If they take a big loss, they may never fully recover. Target range strategies seeks to avoid large drawdowns, so investors don’t suffer from losing their major capital.

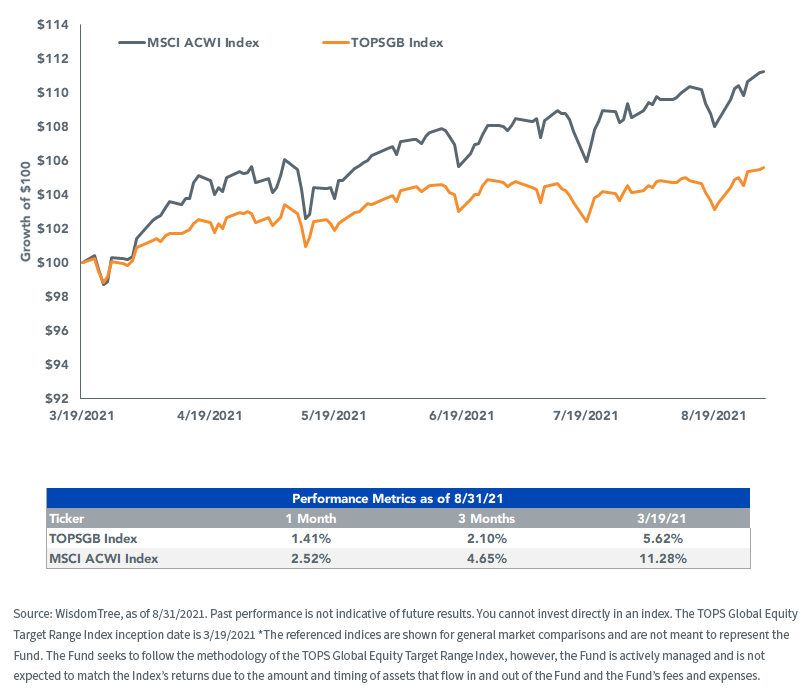

As shown in the chart and table below, target range strategies, as represented by TOPS Global Equity Target Range Index4, were able to participate in equity markets upside while also dampening volatility.

Conclusion

With market uncertainty near all-time highs and interest rates near zero, we believe GTR can provide investors with upside potential and limited downside protection during periods of unprecedented uncertainty.

For more information on GTR, contact your WisdomTree representative or visit WisdomTree.com.

1To the extent the Fund employs a call spread strategy by selling an “out of the money” short call option on an Underlying ETF, its returns will be limited in the event the Underlying ETF’s share price exceeds the strike price of the short call option sold. In the event an investor purchases Fund shares after the date on which the Fund implements the call spread strategy and the share price of the relevant Underlying ETF has risen in value to a level near the cap, there may be little or no ability for that investor to experience an investment gain on an investment in Fund shares with respect to that Underlying ETF, but such investor will remain vulnerable to downside risks. The maximum potential upside return will be further reduced by the Fund’s fees and expenses, costs of investment and any shareholder transaction fees.

2Returns of the strategy may vary depending on the time of investment. Because the Fund targets returns only within a prescribed range, in the event that the price of an Underlying ETF were to decline over the annual period, the Fund would typically sustain losses of up to the sum of the total value of the long call option and the short option per the value of the target allocation to each Underlying ETF (before fees, expenses, and taxes), i.e., the lower boundary. Each Underlying ETF will perform differently and may or may not reach its lower boundary during the annual period.

3Source: Valmark Advisors, as of 8/31/21. Valmark Advisors has been managing similar target range strategies since 2002.

4Upside potential is capped due to selling out of the money options

Important Risks Related to this Article

Rolling Risk. The Fund’s investment strategy is subject to risks related to rolling. Because of the frequency with which the Fund expects to roll option contracts may be greater than the impact would be if the Fund experienced less portfolio turnover. The price of options contracts further from expiration may be higher, which can impact the Fund’s returns.

Unless otherwise stated, data source is WisdomTree.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. To obtain a prospectus containing this and other important information, call 866.909.9473 or visit WisdomTree.com. Read the prospectus carefully before you invest.

There are risks associated with investing, including possible loss of principal. The Fund is actively managed and implements a strategy similar to the methodology of the TOPS® Global Equity Target Range™ Index (the “Index”), which seeks to track the performance of a cash-secured call spread option strategy. There can be no assurance that the Index or the Fund will achieve its respective investment objectives, or that the Fund will successfully implement its investment strategy. Moreover, while the Fund seeks to target returns within a prescribed range thereby minimizing downside investment loss, there can be no guarantee that an investor in the Fund will experience limited downside protection, particularly short-term investors, investors that seek to time the market and/or investors that invest over a period other than the annual period.

The Fund’s options strategy will subject Fund returns to an upside limitation on returns attributable to the assets underlying the options. The Fund’s investments in options may be subject to volatile swings in price influenced by changes in the value of the underlying ETFs or other reference asset. The return on an options contract may not correlate with the return of its underlying reference asset. The Fund may utilize FLEX Options to carry out its investment strategy. FLEX Options may be less liquid than standard options, which may make it more difficult for the Fund to close out of its FLEX Options positions at desired times and prices. The Fund’s use of derivatives will give rise to leverage and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning and you may lose money.

Investment exposure to securities and instruments traded in non-U.S., developing or emerging markets can involve additional risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and more developed international markets. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.