Thinking About Emerging Markets in 2022

Emerging markets (EM) investors experienced a roller-coaster ride in 2021.

Global economic recovery, inflation, commodity prices and threats of Chinese corporate regulation were among the main drivers in a year where the broad MSCI EM Index (MSCI EM) lost 2.54%.

2021 also saw the largest return dispersion in 18 years in favor of the MSCI EM Value Index versus the MSCI EM Growth Index, with the former outperforming the latter by 12.47%.

Our WisdomTree Emerging Markets ex-State-Owned Enterprises Index (EMXSOE) also saw increased volatility and drawdowns last year as our state-owned enterprise (SOE) screen slightly tilts the portfolio away from value sectors and into companies with higher profitability metrics and growth potential.

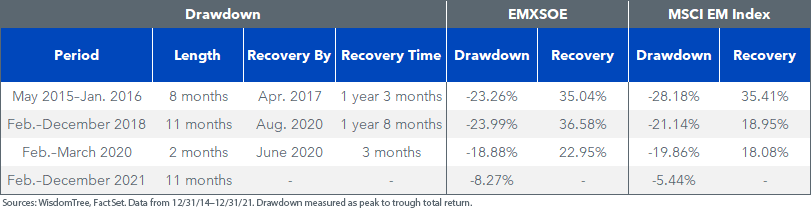

Time to Recover

EMXSOE’s drawdown from February 2021 to December 2021 ranks the fourth largest since the Index’s inception in 2014 and is comparable to the one from 2018 when EM Growth underperformed EM Value. On all previous occasions, drawdowns were close to or in excess of -20%, and the recovery time was slightly higher than the length of the drawdown.

A common adage in EM investing is to “avoid being a tourist.” Volatility can make investors skittish and sell at exactly the wrong time. We fear there could be a lot of EM “tourists” who unwind allocations after a disappointing 2021—we would advise against this impulse.

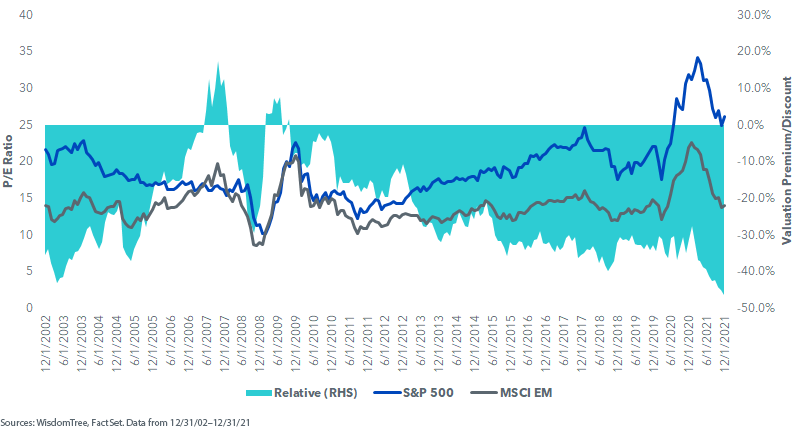

Look at Valuations!

EM carries an important valuation discount relative to U.S. markets, as measured by the S&P 500 Index, because these stocks tend to be riskier, and investors require a higher risk premium. As of the end of 2021, the relative valuation discount between MSCI EM and the S&P 500 reached a 20-year maximum (minimum) as MSCI EM’s P/E fell north of 36% last year.

Lower P/Es are not always strong buy signals, as these can move because of two reasons: lower (higher) prices and higher (lower) earnings. In the case of EM in 2021, valuations became more attractive due to both lower prices and increasing earnings.

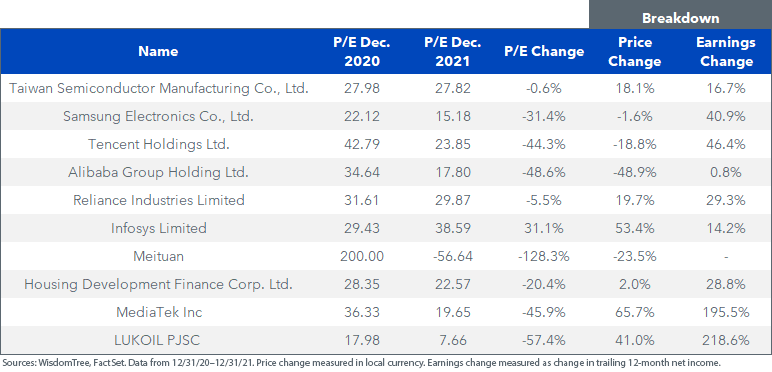

The table below shows EMXSOE’s 10 largest holdings along with their starting and ending P/E ratios.

Except for Infosys, whose P/E increased, and Meituan, which became unprofitable, the other eight companies saw a reduction in their P/E ratio.

As we can see in the breakdown columns, this P/E reduction was led by earnings growth outpacing price growth or, in some cases (Tencent and Alibaba), prices trending negatively while earnings grew or remained unchanged.

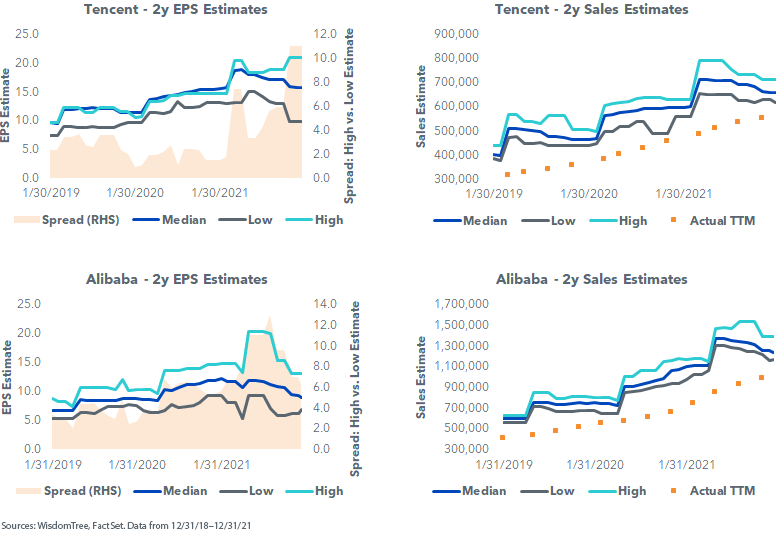

Chinese Regulation and Its Effects on Estimates

As mentioned earlier, one of the main drivers for price movement in 2021 was the Chinese government’s regulation threat on retail technology companies like Alibaba, Tencent and JD.com, among others. The extent and impact of this regulation is still unclear, but the market’s reaction in most cases was to “sell and wait.” Meanwhile, analysts have attempted to incorporate these into their top- and bottom-line forecasts. It is interesting to see how, after the spread in analyst estimates widened with uncertainty last summer, expectations are for both companies to continue growing albeit at a slightly slower pace than in the past.

The question is: Did the market pull back too much?

Only time will tell, but we contend that these companies still have stellar growth trajectories and that valuation discounts between 40% and 50% from year-end 2020 levels present an attractive entry point.

Conclusion

After a volatile 2021 driven by headline risk, we expect EM prices to return to being driven by company fundamentals. As we’ve illustrated with our Alibaba and Tencent examples, sales estimates have clearly been re-rated lower on account of an uncertain regulatory backdrop. With that being said, the market seems to have fully priced in this regulatory risk—and then some.

Alejandro Saltiel joined WisdomTree in May 2017 as part of the Quantitative Research team. Alejandro oversees the firm’s Equity indexes and actively managed ETFs. He is also involved in the design and analysis of new and existing strategies. Alejandro leads the quantitative analysis efforts across equities and alternatives and contributes to the firm’s website tools and model portfolio infrastructure. Prior to joining WisdomTree, Alejandro worked at HSBC Asset Management’s Mexico City office as Portfolio Manager for multi-asset mutual funds. Alejandro received his Master’s in Financial Engineering degree from Columbia University in 2017 and a Bachelor’s in Engineering degree from the Instituto Tecnológico Autónomo de México (ITAM) in 2010. He is a holder of the Chartered Financial Analyst designation.