Petrobras: A Case Study for Avoiding SOEs in Emerging Markets

It took only one day in 2023 for markets to validate our preferred approach to investing in emerging markets: avoiding state-owned enterprises (SOEs).

During the first trading session of the year, Brazilian oil giant Petroleo Brasileiro SA (Petrobras) and lender Banco do Brasil SA, both under the control of the Brazilian government, tumbled about 4% and 6% apiece after President Luiz Inacio Lula da Silva announced a few consequential economic policies in his first days in office.

Though he emphasized the role he envisioned Brazilian state-owned companies would play in spurring growth, markets didn’t share his ambition or enthusiasm. He immediately introduced a list of companies, including Petrobras, to be removed from existing privatization plans, and the selloff ensued.

Lula also handpicked a senator from his own political party, Jean Paul Prates, to become the new CEO. Prates is expected to redirect Petrobras into the renewable energy business and enact other operational changes that may reduce profits and dividends and adversely impact shareholders.

Both companies dragged down the local Bovespa Index by more than 3% as a result; a combination of their common and preferred shares had comprised about 11.5% of the Index to end the year. Their U.S.-listed depositary receipts slumped about 8%–10% during the first U.S. session of the year as well.

Petrobras Is an Unfriendly Reminder of SOE Risks

Though their impact was more benign in the broader emerging markets universe, the investment implication remains clear and acute. SOEs in emerging markets carry substantial political risk due to dependency on and influence from the local government, which often misdirects business operations and initiatives for its own interests rather than those of shareholders.

That’s why we launched our flagship approach to EM investing more than eight years ago. The WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE) eliminates exposure to companies classified as SOEs, which we define as those where the government owns more than 20% of shares outstanding.

The non-SOE allocations, therefore, retain the financial and operational autonomy to pursue profitable projects and efficient operations to deliver shareholder value rather than becoming bloated, stodgy vessels for political interests.

Our approach has been rewarded as well. After the global financial crisis, non-SOEs began to differentiate themselves as performance drivers in emerging markets versus their state-owned counterparts. During strong bull markets, they’ve recorded significant outperformance.

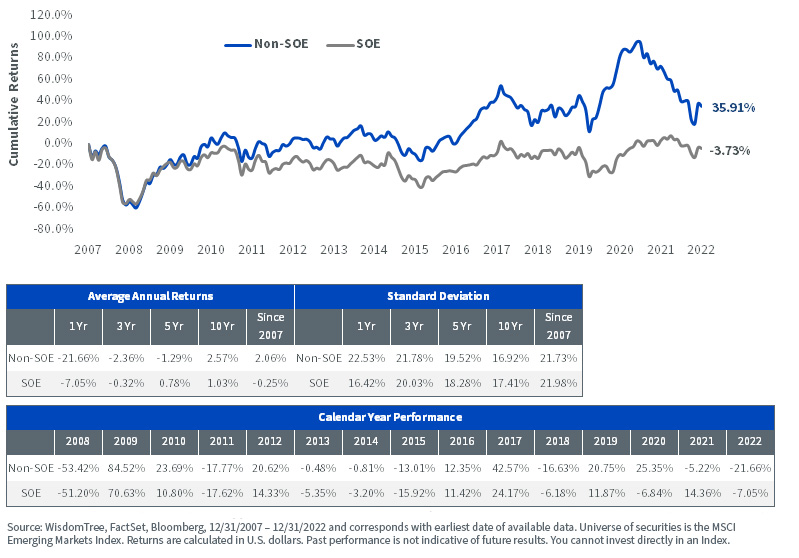

Cumulative Performance: SOEs vs. Non-SOEs

Despite the volatility and underwhelming performance of EM in 2021 and 2022, non-SOEs still managed to outperform SOEs over nine of the last 14 calendar years, dating back to the beginning of our data series in 2008.

The recent volatility and underperformance of non-SOEs have been slightly misattributed as well. Emerging markets have struggled since the middle of 2021, when the Chinese (a 32% weight in the MSCI Emerging Markets Index) government began implementing anti-business policies on private enterprise and profitmaking. This disproportionately hurt its domestic Technology sector and weighed heavily on EM sentiment for the next year. Strict policies intended to eliminate the spread of COVID-19 compounded the effect, stifling Chinese economic activity for much of 2022, though recent policy developments have encouraged the possibility of an economic “reopening.”

Against this backdrop, SOEs outperformed non-SOEs mainly due to the nature of the businesses involved (more on that below). Heading into 2023, the sour sentiment that plagued China and EM for much of the last two years seems like it’s starting to reverse.

Over the longer term, however, the performance evidence suggests that non-SOEs can also potentially endure the volatility of EM investing better than SOEs with similar levels of risk. Since 2007, non-SOEs have added an annualized 1.4% per year, while SOEs themselves have lost almost 70 basis points.

The removal of SOEs also results in a unique stock basket featuring more growth-oriented and consumer-friendly exposures versus the broader EM universe.

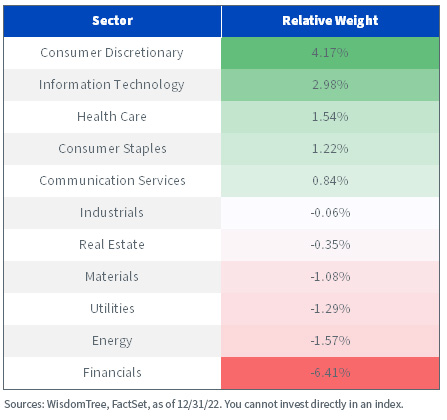

Average Sector Comparison of XSOE vs. MSCI Emerging Markets (since Dec. 2014)

Historically, XSOE has concentrated more weight, on average, in the Consumer Discretionary and Information Technology sectors than the MSCI Emerging Markets Index. It also has remained deeply under-weight in Energy (such as Petrobras) and Financials (such as Banco do Brasil), two of the more prominent state-controlled industries, by about 8%.

Non-SOEs May Recover in 2023

The circumstances surrounding Petrobras in Brazil are the latest anecdote to substantiate our view that SOEs should be avoided in emerging markets, and we further believe there will be more examples to justify this approach later in 2023. Meanwhile, we’re encouraged by some of the historical performance and portfolio composition advantages to lean into non-state-owned enterprises for long-term EM investing.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments. Funds focusing their investments on certain sectors and/or regions increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.