Fed Watch: Speed Limit 25

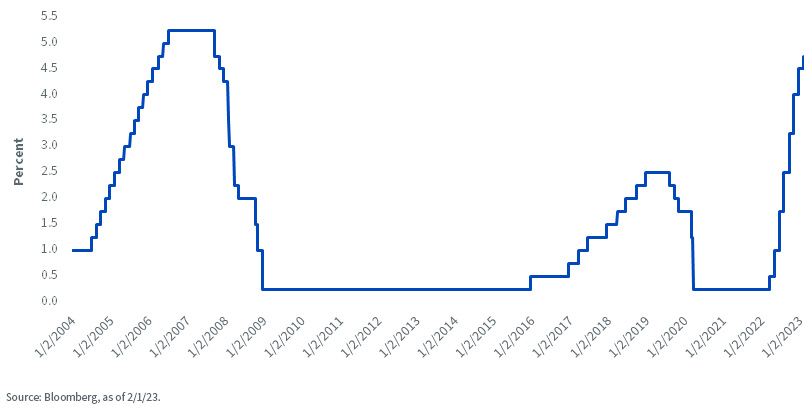

For the second meeting in a row, the Fed downshifted its pace of rate hikes, this time lowering the “speed limit” to 25 basis points (bps) from December’s 50 bps increase. As a result, the new Fed Funds trading range comes in at 4.50% to 4.75%. Given recent Fed-speak, this slower pace of tightening was pretty much expected. Now the conversation is quickly turning to whether another quarter-point move could be coming at the March FOMC meeting or if this new Fed Funds target represents the peak in this rate hike cycle.

Beginning with the December FOMC meeting and continuing here in early 2023, Fed officials have readily acknowledged the rapid pace of rate hikes implemented thus far and how the effects come with a lag. As a result, lowering the speed limit was viewed as a prudent course of action at this stage of the tightening cycle.

Fed Funds Target Rate—Upper Bound

Let’s take stock of where the economy and inflation stand to see what may be coming next. Signs reveal that inflation has not only peaked but could be cooling quicker than policy makers expected. The Fed’s preferred PCE inflation gauge dropped to a year-over-year rate of +5.0% in December (still well above the 2% threshold, though), while the Fed median projection was at +5.6%. Although Q4 real GDP increased +2.9%, underlying gauges for domestic demand, such as final sales to private domestic purchasers, rose a scant +0.2%.

On the other side of the trade, the labor market still seems to be in good shape, as illustrated by the latest weekly jobless claims number. Total claims fell for the third week in a row to 186,000, or little changed from the level printed before the Fed started its rate hikes last March. In addition, financial conditions have continued to loosen, falling back to March 2022 readings as well. This point is probably frustrating Chairman Powell, to say the least.

What comes next will undoubtedly dominate the investment landscape as we move forward. Specifically, which time-tested adage will ultimately win out: don’t fight the Fed or don’t fight the tape? As we have discussed in blog posts and podcasts recently, the U.S. Treasury (UST) market is not buying what Powell & Co. are selling. And if you look at where we were a year ago, who can blame it? Remember, in January 2022, the voting members were operating under a dot plot that projected only a couple of rate increases for the year. That was 450 bps ago, so you can see where the UST market is coming from.

Conclusion

The bottom line is that we appear to be finally reaching the endgame for rate hikes. This will eventually lead us to the hard part of the equation. Whether the Fed delivers another quarter-point rate hike or even an additional increase after that (which would push the upper bound of the Fed Funds range above the 5% threshold), the more important issue for the money and bond markets will be how long policy makers stay on hold. The ultimate question, or true Powell pivot, is whether or when the Fed will provide guidance on the timing for rate cuts. If you’re looking for clues to help navigate this uncertainty, future jobs reports will no doubt take on an elevated level of importance in the Fed’s decision-making process. As I mentioned, there seems to be a consensus among voting members not to reverse course too soon, but as we’ve seen, things can change quickly.