Could You Predict WisdomTree’s Top-Performing Strategy to Start 2023?

Nearly every asset manager has their version of an investment outlook for 2023, and WisdomTree is no different. It’s an interesting exercise to undertake. At the end of it, however, humility comes from knowing that we cannot accurately predict, no matter how much work we do, which of our own Funds will perform best over any period.

Amazingly, January is already over—one month down, eleven to go for 2023. Did you have any thoughts as to how the year would begin? In this piece, we look at the performance of WisdomTree’s best 5 and worst 5-performing exchange traded funds (ETFs), measured on a net asset value (NAV) basis.

The performance data quoted represents past performance and is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For the most recent month-end performance, please click the respective fund ticker: WTAI, WCLD, PLAT, WBAT, GDMN, IXSE, USDU, EPI, GCC, USFR.

We seek to explore answers to questions like:

- Value-oriented equity strategies or growth-oriented strategies? Last year was characterized by value leading the way, so it’s really a case of whether 2023 is a continuation or a shift toward a different trend.

- Profitable companies, many of which pay dividends, or riskier, higher duration companies that are earlier in their life cycles, without histories of demonstrating positive net income? These risky companies did very well in 2020 and parts of 2021, but then in 2022 there was a sharp shift in the trend, and they massively underperformed.

- U.S. equities or non-U.S. equities? It’s possible that certain fundamentals may lead to predictions of non-U.S. equity leadership—but there have been many years where U.S. equities have won the day even in the face of similar indications.

These are but a few questions that we know were on the minds of investors to start 2023. With one month down—admittedly a short period—have we learned anything interesting so far from the actual results?

WisdomTree’s BEST-Performing Strategies to Start 2023

The WisdomTree Artificial Intelligence and Innovation Fund (WTAI) delivered the strongest performance (+21.60% at NAV) of any of WisdomTree’s strategies. This would have been a very challenging prediction to make, knowing what we knew as 2022 was winding down:

- This strategy is highly exposed to semiconductor companies. While we like the long-term case for these companies, recognizing that modern life cannot be lived without these products, to predict that they would rally in January 2023 would have been difficult. Earnings reports from these companies leading into the end of the year were almost universally negative. It would have been difficult to find anyone saying anything positive about this space. Even the companies’ CEOs were doing all they could to downplay expectations—and perhaps part of the early 2023 rally tells us they did a good job.

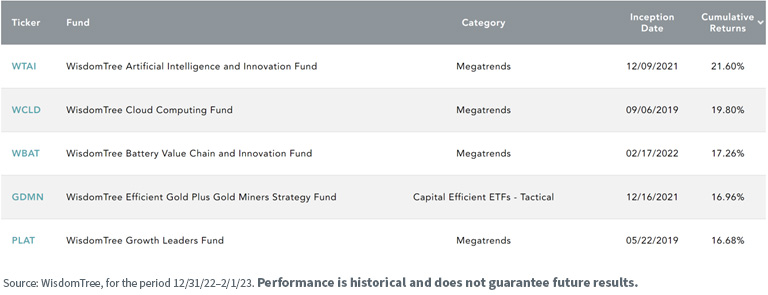

Looking down the rest of the list in figure 1, WisdomTree’s top-performing strategies to start the year, we see:

- The WisdomTree Cloud Computing Fund (WCLD) and WisdomTree Growth Leaders Fund (PLAT) had strong returns. The fact they were in the top five, and that both returned above 15% for the month, tells us that the performance of technology broadly was strong. It also tells us that the software space within technology, frequently newer companies less likely to have positive earnings, also did well. This is a big difference to what we saw during 2022. We don’t know if it will continue, but it is a shift from 2022’s trend.

- The WisdomTree Battery Value Chain and Innovation Fund (WBAT) also made the top five. By virtue of the fact that a lot of battery processing and manufacturing occurs in China, this strategy has a big China exposure. This is another notable shift in trend from 2022, in that China has now ended COVID lockdowns and markets have been rallying on improved growth expectations as a result of this policy change.

- Rounding out the top five is the WisdomTree Efficient Gold Plus Gold Miners Strategy Fund (GDMN). Broad economic uncertainty and recession fears remain, even if certain riskier parts of the global equity market are rallying. This strategy is quite specific, telling us that the performance of gold, as well as the performance of gold miners, has been ticking up. This strategy could be one to watch as further months evolve.

Figure 1: WisdomTree’s Top 5 Performing ETF Strategies, on a Net Asset Value (NAV) Basis

For full Fund performance and other important information, click the Fund's ticker: WTAI, WCLD, WBAT, GDMN, PLAT.

Just as we can learn from the top performers, we can also learn from the bottom performers, which we see in figure 2:

- Three out of the bottom five performing ETFs had a negative return over the period, and two were focused specifically on India’s equities. The WisdomTree India ex-State-Owned Enterprises Fund (IXSE) and WisdomTree India Earnings Fund (EPI) tend to provide broad exposure to India’s equities, and while we like India’s long-term prospects, over any shorter period, there can be volatility. Additionally, to see that the worst performing Fund was not even down 3% tells us that January 2023 was clearly risk-on in nature, globally.

- The WisdomTree Bloomberg U.S. Dollar Bullish Fund (USDU) represents a strategy that did very well in 2022, given the strength of the U.S. dollar against other world currencies. However, 2023 may not see the same levels of dollar strength, and the first month of the year’s observation seems to support this.

- The WisdomTree Enhanced Commodity Strategy Fund (GCC) delivered a positive return of 0.27%, telling us that a diversified commodity strategy was able to showcase a positive return for the month, but that the return was not that much above 0%.

Figure 2: WisdomTree’s Bottom 5 Performing ETF Strategies, on a Net Asset Value (NAV) Basis

For full Fund performance and other important information click the Fund's ticker: IXSE, USDU, EPI, GCC, USFR.

Can these Trends Continue?

Our honest answer when asked any question requiring a crystal ball and view of the future is—we don’t know. Technology-oriented thematic Funds, many of which are seen in the top five in figure 1, experienced massive corrections in 2022. It’s possible that these strategies were just due for a rebound. Earnings announcements that we have seen so far are mixed, in that you can find companies with very positive stories surrounding them and you can find others with quite negative stories. If history is any guide, it is unlikely that risk-on strategies can deliver smooth positive performance for a full year—there has almost always been volatility—even if the full year result can look quite strong.

We certainly look forward to continuing to track this as the year goes on.

Check out our Performance at a glance tool to dig more into January’s Top 5 and Bottom 5 performing ETFs.

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he was based out of WisdomTree’s London office and was responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. In November 2021, Christopher was promoted to Global Head of Research, now responsible for numerous communications on investment strategy globally, particularly in the thematic equity space. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst Designation.