Too Much of a Good Thing

We are committed to the dividend and to a very healthy and competitive dividend.

- Intel CEO Pat Gelsinger, January 27, 20231

Less than a month after that statement, Intel announced a reduction of its quarterly dividend, from $0.365 dividend per share to $0.125—a cut of 66% and a saving of $4 billion a year.

Ostensibly, Intel’s dividend looked enticing entering the year.

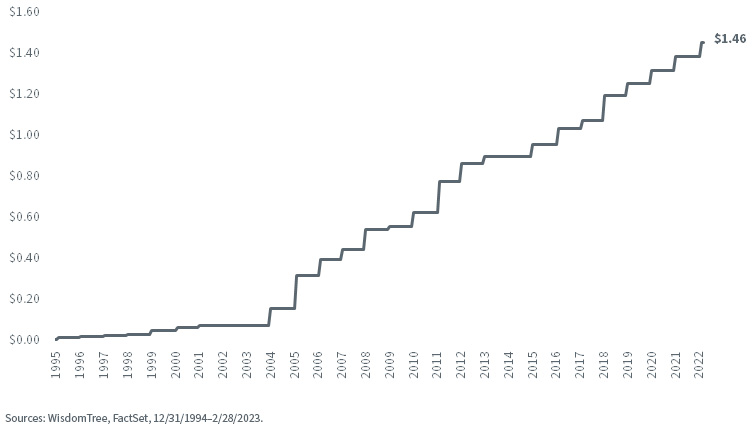

The company has consistently maintained—and often raised—the dividend each year over the last 25+ years.

Intel Annual Dividend per Share

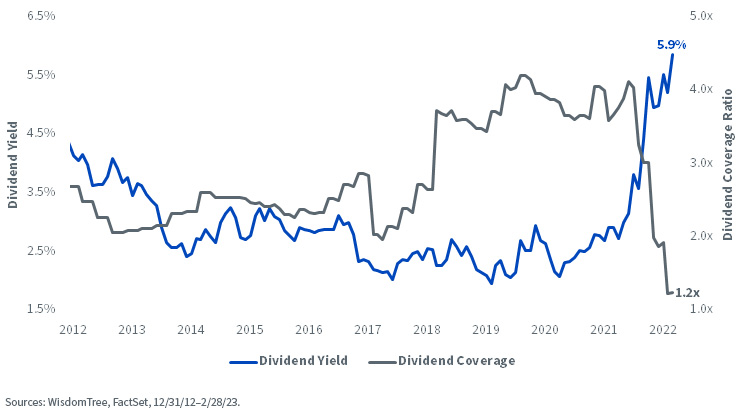

The dividend yield eclipsed 5.5% by the end of last year, ranking it as the fourtheenth-highest yielder in the S&P 500, the highest among S&P 500 Information Technology companies, and the second-highest in the Dow after Verizon.

But that high dividend yield also showed signs of trouble.

The dividend yield skyrocketted not because of a massive increase in dividends per share—see the small yet steady annual increases in the previous chart—but because of its plummetting stock price and concerns over the reliability of the dividend.

Intel’s dividend yield was just under 2% in January 2020. This year, the dividend yield had reached as high as 5.9%. Following the dividend cut, the dividend yield is back below 2%.

If the surging dividend yield was the preliminary red flag on dividend safety, the rapid drop in the dividend coverage ratio—earnings per share divided by dividends per share—from over four times to nearly one times provided another.

Intel Trailing 12-Month Dividend Yield and Dividend Coverage Ratio

It is rare for an S&P 500 company to cut a dividend, particulary for a payer as large as Intel. The last major S&P 500 dividend cut was last year’s roughly 50% cut from AT&T.

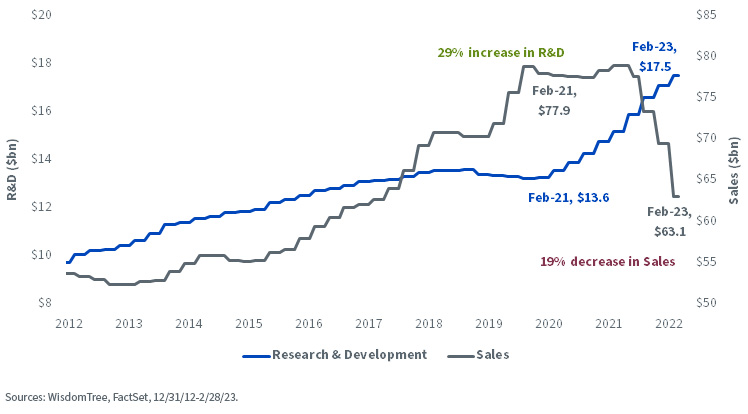

A strong ramp up in research and development (R&D) spending with a sudden slowdown in sales caused Intel to trip up on fulfilling its dividend obligations.

Over the last two years, sales decreased 19%, while R&D jumped nearly 30%.

Intel Trailing 12-Month R&D and Sales

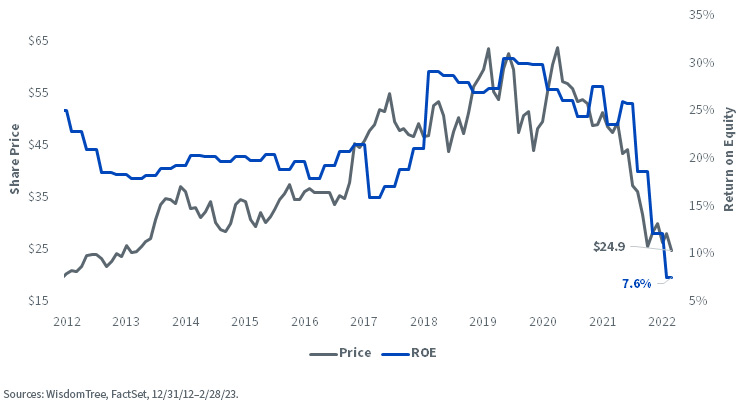

The bottom line impact to the company has been a share price that is down 60% from its 2021 high and a return on equity (ROE) that has nose-dived from over 30% just two years ago to less than 10% today.

Intel Share Price and Trailing 12-Month ROE

WisdomTree Composite Risk Screening

Are there ways to capture dividend cuts like this one? The CEO was adamant the company would maintain the dividend just four weeks before cutting it.

WisdomTree added a composite risk screen (CRS) to its methodology of dividend indexes to mitigate exposure to a company like Intel.

Our purely quantitative model identified the riskiness of Intel’s dividend and flagged the security out of the investible universe at the December reconstitution of the U.S. dividend strategy.

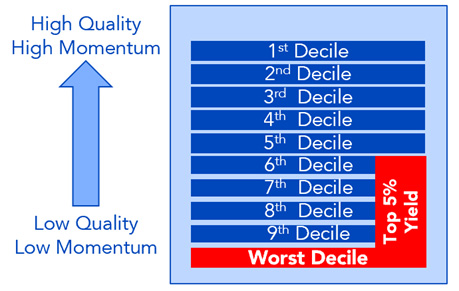

As a recap of the process, we aim to mitigate exposure to the riskiest dividend payers in two ways:

- Screening out companies that rank in the bottom decile of our starting universe of publicly traded companies based on a CRS of quality and momentum factors

- Screening out companies that rank in the top 5% by dividend yield and also in the bottom 50% based on the CRS

All stocks (dividend payers or not) are ranked on this CRS across six distinct universes: three regions (U.S., developed international and emerging markets) separated between large-/mid-cap and small-caps. This allows for comparing stocks with more ‘like-for-like’ peers.

The dividend yield rankings are similarly constructed within these six distinct universes. As we show in the charts below, companies in the bottom decile on CRS are removed, as well as the companies in the bottom half of the CRS that are also in the top 5% of the respective universe according to yield.

WisdomTree Composite Risk Screen

As of the latest Index refresh,2 Intel’s dividend yield of 5.1% would have qualified for the high dividend subsets that rank by yield. But because Intel scored in the tenth (worst) decile of the composite risk screen it was ineligible for WisdomTree’s dividend Indexes.

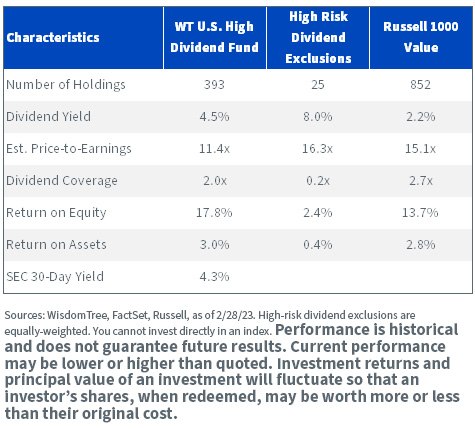

The WisdomTree U.S. High Dividend Fund (DHS), which tracks the WisdomTree U.S. High Dividend Index, holds nearly 400 companies with the highest dividend yields. At the December 2022 rebalance, 25 companies—the high-risk dividend exclusions—were screened out of the universe, based on the composite risk screen.

Though the high-risk dividend exclusions sport an attractive 8% yield, the basket has a dividend coverage ratio well below one times—meaning dividend payouts are in excess of earnings.

DHS, on the other hand, has a dividend coverage ratio of two times—earnings are double dividend payouts—with profitability metrics above the Russell 1000 Value Index.

While these high-risk dividend exclusions have a much higher average yield, the P/E ratios are higher than the Russell 1000 Value and the profitability levels far worse.

The Value Rotation

Our team believes a multi-year value cycle began in 2022. As risk of an economic slowdown and ultimate recession rises with each further interest rate hike from the Fed, the sustainability and health of dividends will become just as important as the level of dividend yield. Companies thrived with the economy humming, but we believe our composite risk screen will be an increasingly valuable component of our process in an inevitable economic slowdown.

Fundamentals Comparison

For definitions of terms in the table above please visit the glossary.

Standardized performance and performance data for the most recent month-end is available on the WisdomTree U.S. High Dividend Fund (DHS) webpage.

This information must be preceded or accompanied by a prospectus, click here to view or download prospectus.

1 Brian Sozzi, “Intel CEO: ‘We are committed to the dividend,’” Yahoo! News, 1/27/23.

2 11/30/22, the screening date of the WisdomTree domestic dividend indexes

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.