The Tech Bust Is Prompting Dividends’ Mean Reversion

Sometimes our own worst enemy is a cloudy memory. It has only been a bit over a year since the stock market started its rotation out of growth and into value, but it seems like forever ago that Big Tech was marching to new highs. At the same time, unprofitable “stay-at-home” stocks and other companies that benefitted from Covid’s societal changes were laying waste to value investors’ relative performance.

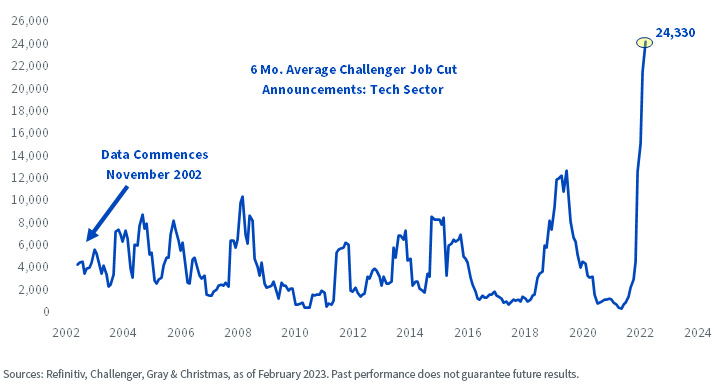

Flash forward to today, when conditions are a far cry from those that prevailed in 2021. The Challenger report for February is telling us the tech sector may have to contend with the bust stage of the economic cycle in 2023 (figure 1).

Figure 1: The Challenger Report Illuminates Tech’s Overcapacity

With dividend stocks holding up better than the broad market last year, it may be easy to forget how torturous things were for value when pricey Big Tech stocks were on their long runs before, during and after Covid.

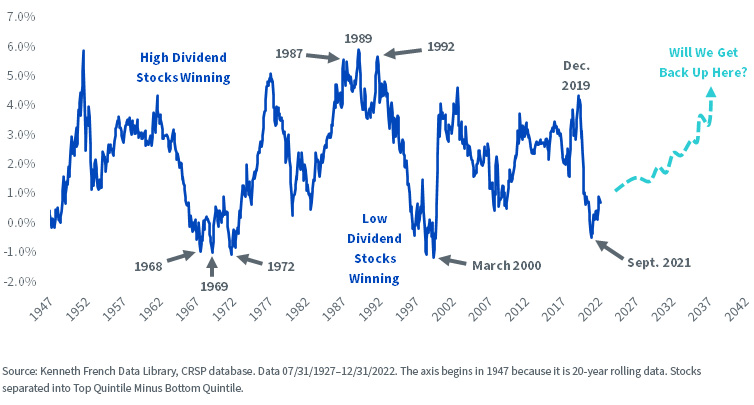

Using the data library compiled by Dartmouth’s Ken French, something that jumps out in figure 2 is the 20-year period to September 2021. That window captures most of WisdomTree’s history since we first launched ETFs in June 2006.

Figure 2: 20-Year Rolling Annualized Outperformance, High Dividend Stocks Minus Low Dividend

Stocks

The heartening thing about figure 2 is what happens a couple decades after the extremes. Perhaps the setup is “high dividends for the 2020s and 2030s.”

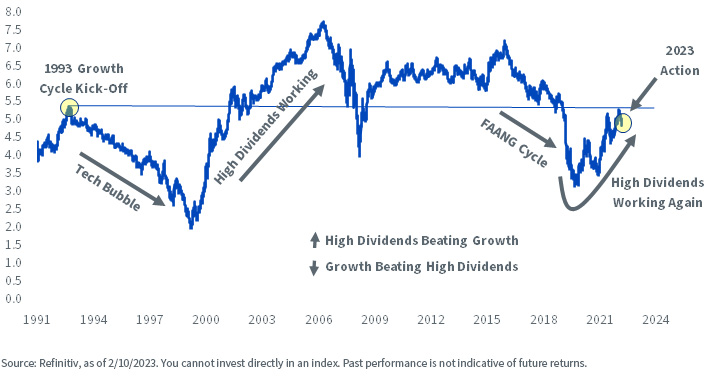

Figure 3 puts the extent of the now-ended growth run in some context. Comparing it to growth stocks’ legendary performance in the 1990s, the magnitude of the outperformance during what I’ve labeled the “FAANG” cycle is similar. However, the snapback over the last year or so has been bold; growth vs. high dividends is now at a total return stalemate since 1993, the year that era’s growth cycle commenced.

Figure 3: S&P 500 High Dividend Index Relative to S&P 500 Growth Index (Total Return)

Unlike just a short while ago, the market no longer seems willing to give a free pass to Facebook-parent Meta, along with Apple, Amazon, Google-parent Alphabet and Netflix (the FAANGs). Considering the increasing attention to tech layoffs, that may continue to be the case until economic conditions improve.

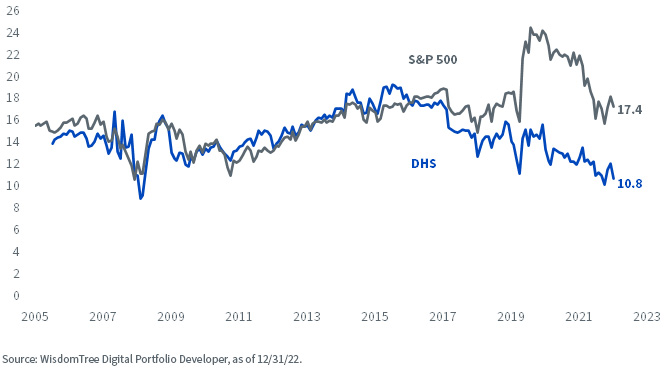

One of our deeper value concepts is DHS, the WisdomTree U.S. High Dividend Fund. Despite the comeback in value, it still trades at a wide discount to the S&P 500, a condition that only began to creep up when things got really whacky in the stock market amid the Covid money splash (figure 4).

Now, as the whacky becomes un-whacky, maybe the 20-year time series between high and low dividends spends the coming years mean reverting. If that’s the case, DHS deserves a look.

Figure 4: DHS’s P/E Discount

Important Risks Related to this Article

DHS does not have any exposure to the stocks mentioned in this blog.

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.