Quality and Pricing Power: An Unsuspecting Inflation Hedge?

We often define quality companies by measuring profitability and the efficiency of their capital usage to generate robust operating results. Assessing return on equity (ROE), return on assets (ROA) and leverage therefore becomes paramount.

But investors also gravitate to quality for its defensive characteristics during economic downturns and periods of market volatility.

Back in December, my colleague Pierre Debru authored a blog post that expanded on the defensive prowess of quality companies through another lens: their ability to maintain high pricing power in inflationary environments.

He explained that a company’s ability to pass the higher input costs of labor, supplies and energy onto its “captive” customers (via higher sales prices) helps relieve the pressure of narrowing margins during inflationary periods, thereby defending their bottom line.

While the global economy continues to battle with record inflation, I thought it would be worthwhile to examine this concept in detail with WisdomTree’s own quality suite.

Improving Margins: A Marriage of Quality Stocks and Fundamental Weighting

WisdomTree’s quality suite covers the U.S. large-cap, small-cap, developed international and emerging markets universes by allocating to equities with the highest quality scores, which are a mixture of static and trend-based profitability measures such as ROE and ROA. Each basket is dividend-weighted, resulting in Funds with high-quality profiles whose companies have the potential to grow their dividend payments in the future as well.

They have also exhibited strong profit margins throughout the high inflation environment of the last two years compared to broader indexes, suggesting that quality stocks indeed have a competitive advantage with higher pricing power and captive customer bases.

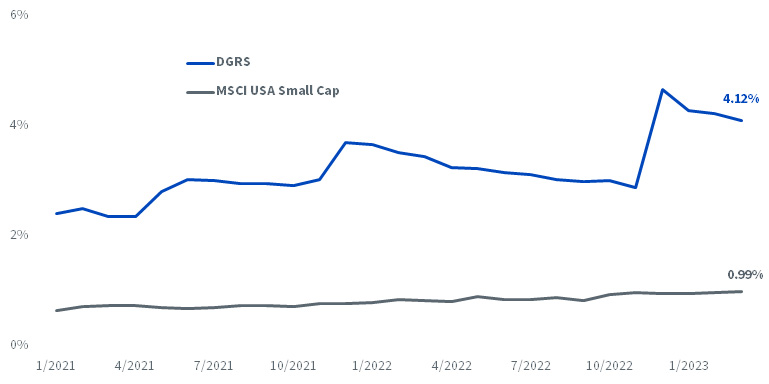

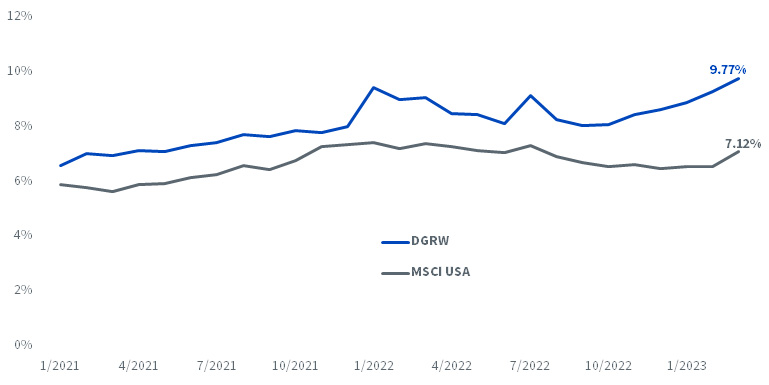

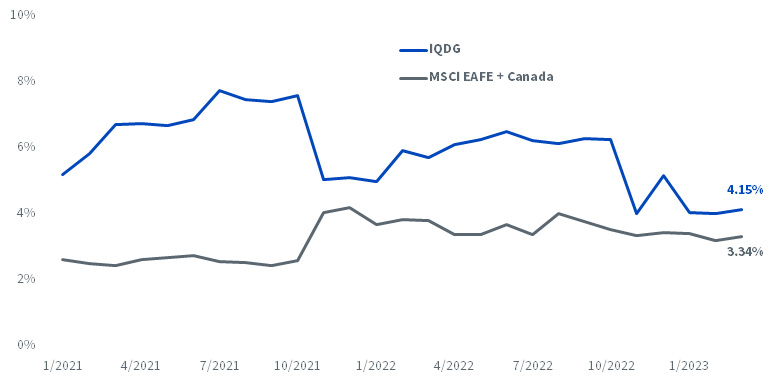

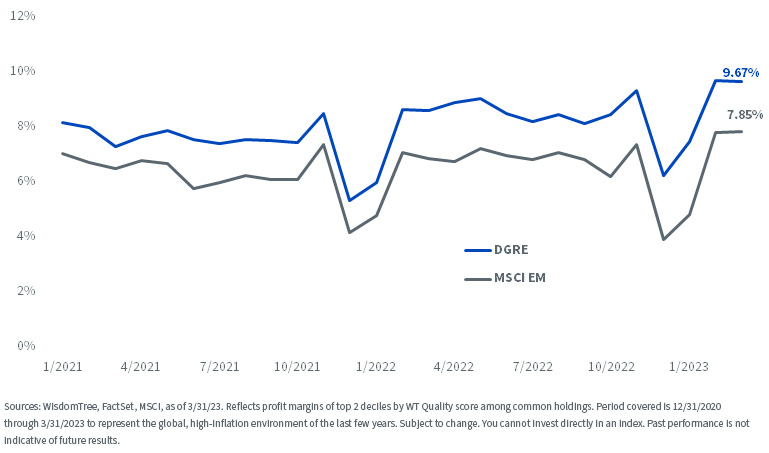

The below charts illustrate the profit margins of the top two deciles, ranked by WisdomTree’s quality scoring methodology, of common holdings between one of WisdomTree’s quality dividend growth Funds and a market cap-weighted index representing the same equity region. Because these deciles represent holdings common to both the Fund and representative index, the improvement in net income margin is attributable to dividend weighting the high-quality stock basket versus traditional market cap weighting.

WisdomTree U.S. Quality Dividend Growth Fund (DGRW) vs. MSCI USA

WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS) vs. MSCI USA Small Cap

WisdomTree International Quality Dividend Growth Fund (IQDG) vs. MSCI EAFE + Canada

WisdomTree Emerging Markets Quality Dividend Growth Fund (DGRE) vs. MSCI Emerging Markets

We can draw two important inferences from the improvement in profit margins.

First, we see that the quality factor can potentially provide a hedge against high inflation (perhaps compounding the efficacy of equities against inflation), which we detailed recently, since high-quality companies with captive customers can defend their profit margins better than others with more sensitive, price-elastic customer bases.

Procter & Gamble’s most recent earnings report1 from Friday, April 21, provides a compelling example of this effect. During the quarter, organic sales grew 7% due to a 10% increase from pricing that was only slightly offset by volume (which declined 3%). In the U.S., organic sales grew 6%, which included volume growth rather than a decline, suggesting that consumers were relatively insensitive to price increases and did not meaningfully alter their purchasing behavior.

Notably, Procter & Gamble reported a 16.92% profit margin, only about 1% lower than their average margin over the past eight reported quarters, which dates back to the initial inflationary impulses in the U.S. post-pandemic environment in early 2021. Margins since then have remained consistently rangebound between 15.6% and 21.9%.

DGRW has benefited from their success as well. Procter & Gamble (PG) is currently a top five holding within the Fund at about 3.06% (as of April 21). It has also averaged a 3.5% weight over the past three years while growing its dividend from $0.79 to $0.87 and then to $0.91 per share over the previous eight quarters. More broadly, the top two deciles of companies by quality score within DGRW amount to more than 36% of the Fund as of March 312.

Second, the improvement in profit margin is attributable to dividend weighting when the holdings are identical, as the methodology rewards companies that already have operations healthy enough to grow their dividends in the first place.

If structurally higher inflation persists over the near term, or we encounter a recessionary economic landscape, these innate, defensive characteristics of high-quality companies may buffer investors’ portfolios, as they did in 2022 and throughout much of the post-pandemic environment.

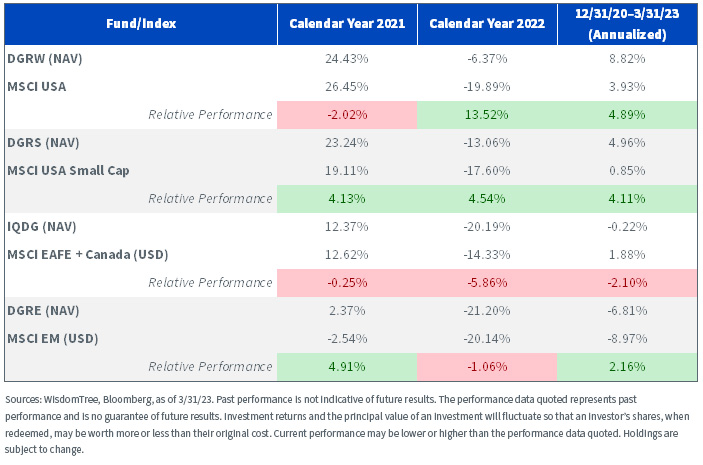

Quality Dividend Growth Performance

For the most recent month-end performance, click the respective ticker: DGRW, DGRS, IQDG, DGRE.

1 Source: Procter & Gamble Q3 2023 Earnings Call transcript from April 21, 2023, obtained via Bloomberg on April 24, 2023.

2 For most recent fund holdings and their percentages please click here.

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than developed markets and are subject to additional risks, such as risks of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.