Managing Portfolios and Clients in Uncertain Times

This article is relevant to financial professionals who are considering offering model portfolios to their clients. If you are an individual investor interested in WisdomTree ETF Model Portfolios, please inquire with your financial professional. Not all financial professionals have access to these model portfolios.

“My name is Austin Powers. Danger is my middle name.”

(Mike Myers as Austin Powers in “Austin Powers, International Man of Mystery,” 1997)

The last time we wrote about talking to clients in turbulent market environments was in October 2022—toward the end of what ended up being a horrible year for both stocks and bonds.

But it seems appropriate to address that topic again. Consider the world around us—geopolitical risk is on the rise, there are wars in Eastern Europe and Sudan, we are about to begin (sigh…) another presidential election cycle, we have gridlock in Congress, we have a Fed that has added uncertainty to the markets as it tries to balance the scales between fighting inflation and maintaining faith in the banking system following several notable failures and many are forecasting both an economic and earnings recession as we move through the year.

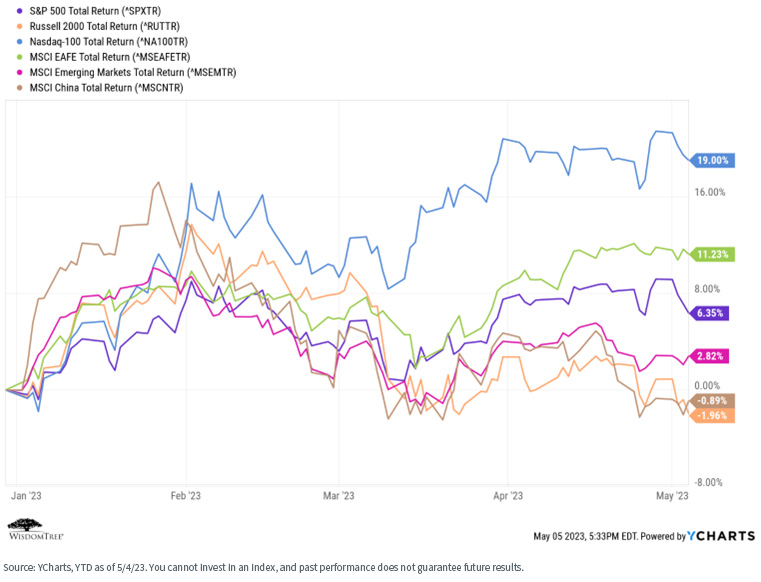

And yet, most global equity markets are positive year-to-date, especially the tech-heavy NASDAQ Index.

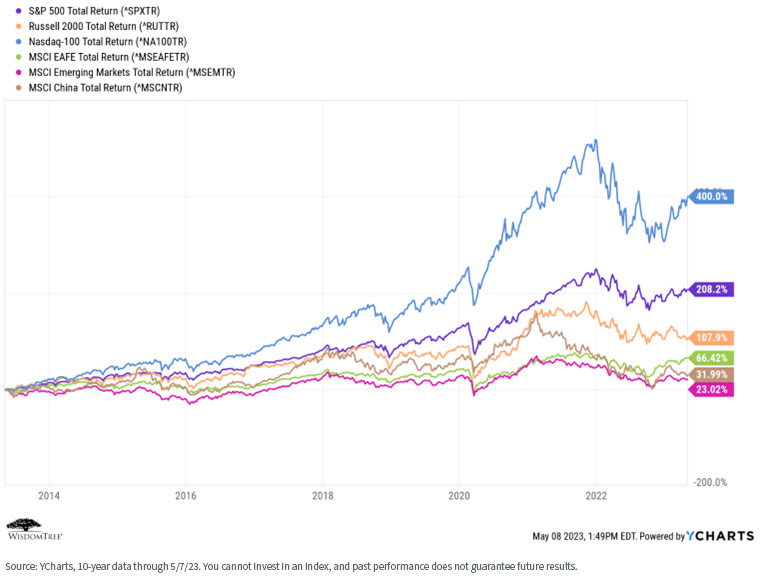

For definitions of indices in the chart above, please visit the glossary.

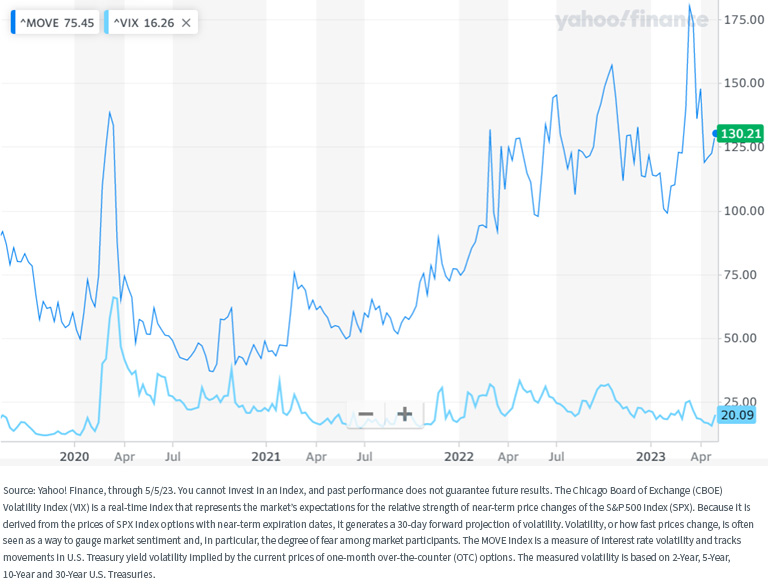

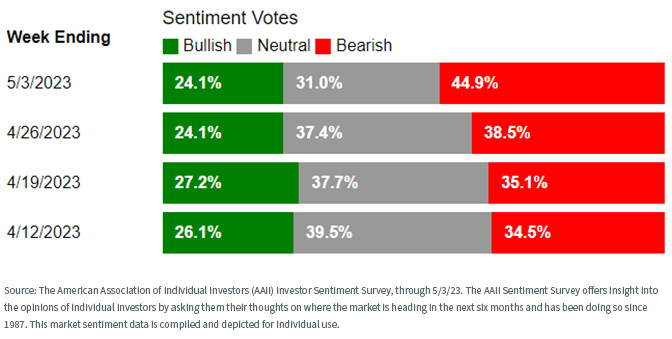

Furthermore, equity market volatility, as measured by the “VIX,” is as low as it has been since early 2022—suggesting an almost shocking level of investor complacency. Meanwhile, the MOVE Index (an indicator of interest rate volatility), after peaking back in March in the wake of the Silicon Valley Bank failure, is trending back downward (though still elevated).

We don’t suggest we are entering a “dark” period such as March 2020 (COVID-19) or the “great financial crisis” of 2008–2009, but markets certainly are…well…uncertain, and investors cannot be blamed for wondering what they should be doing.

So, when discussing current conditions, here are some broad observations and several specific ideas that might benefit your clients.

Broad Market Observations

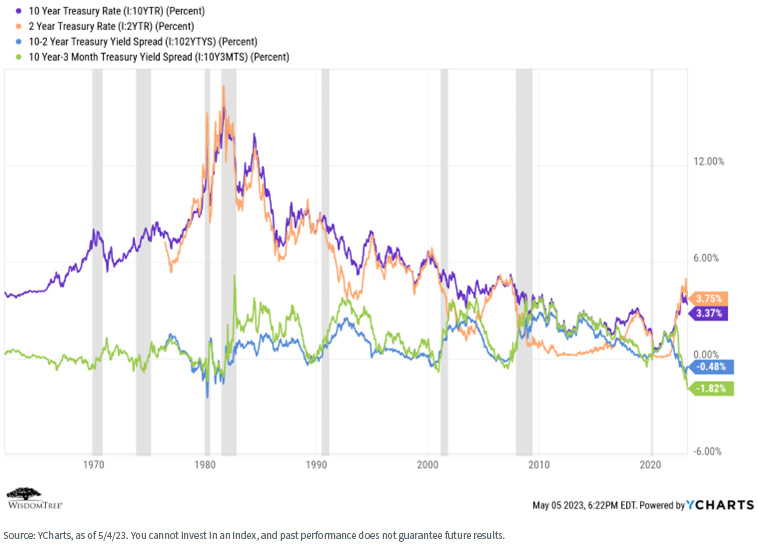

We are not falling apart. Yes, we anticipate a recession at some point in 2023 or 2024—the inversion of the yield curve so steeply and for so long is sending that signal. The gray bars in the historical chart below represent recessionary periods; note that each one since 1962 was accompanied or preceded by an inverted yield curve, and the curve is the most inverted it has been since the deep recession of 1980–1982 (which coincided, unfortunately, with the year I graduated college. Yep, I lived at home that year.)

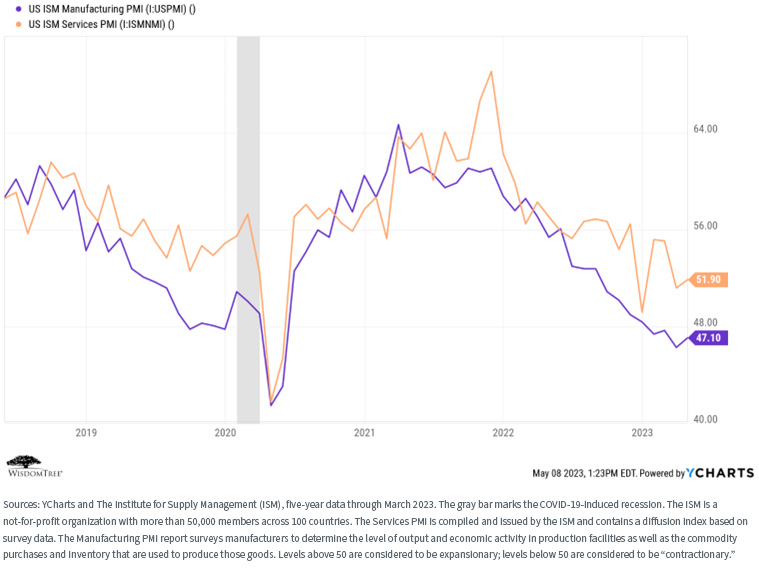

Both manufacturing and services indexes are declining steadily, though the services index remains in modestly expansionary territory (>50).

At the same time, the labor market remains tight, and consumers continue to spend—typically not what you see in recessionary times.

Our Expected Outcome?

The economy is slowing, but we do have a “mixed message” environment in which we face a steeply inverted yield curve, inflation remains high and somewhat “sticky” and we have a Fed walking a tightrope between fighting inflation and maintaining confidence in the banking system.

At the same time, the labor market remains tight, consumers continue to spend and corporate earnings projections are muted but not apocalyptic. Bond market credit spreads—which we think rarely “lie”—suggest corporate America is in okay shape from a balance sheet perspective.

We are not sure we believe in the notion of a “soft landing,” and the Fed certainly finds itself in a “pickle” regarding future policy movements after its 25-basis point hike in early May. We think it will “pause” and take a “wait and see” approach as we move through the summer months. We certainly seem headed for recession, and markets may be volatile, but it may not be as “doomsday” as some suggest.

Recommended Courses of Action:

1. Focus on “all-weather” portfolio construction. Well-diversified investment portfolios are built with full market cycles in mind, with the expectation that periods like this will occur. Remind your clients that market volatility is normal. Many investors became complacent over the course of a 12–13-year bull run and then overly fearful during the horrendous market performance in 2022.

Market timing is notoriously difficult, and we do not recommend it. Stay diversified but stay invested. There is nothing wrong with making moves to improve the quality of your portfolio (e.g., focusing on higher-quality companies with more sustainable growth and dividend characteristics or taking advantage of the odd shape of the yield curve and reducing duration/interest rate risk), but stay invested.

As a financial advisor friend of ours says when his clients ask him what to do: “Wind the clock.” While a bit apocryphal, what we think he means is twofold: (1) Don’t focus on short-term market movement; do something practical instead, like wind your clocks, because (2) in investing, time is your best friend. Here is a chart of global market performance over the past 20 years. The market is not required to always go up, but that does seem to be the trend.

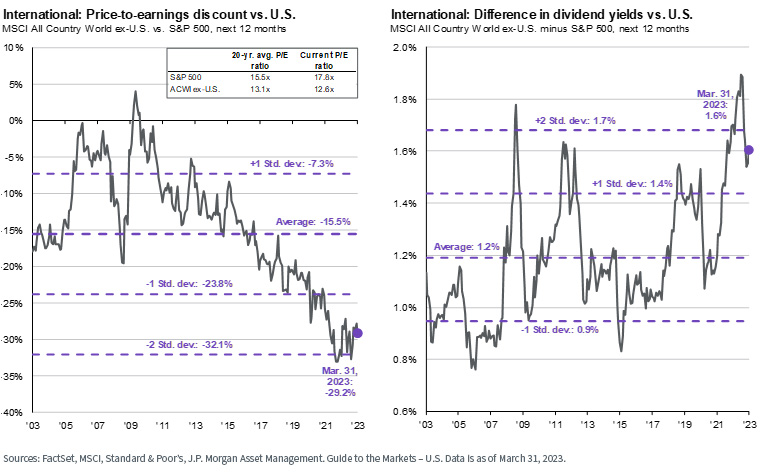

2. Actively seek to avoid common behavioral investment mistakes. In times of stress, many investors default to behaviors that can harm long-term performance. One example of this is home country bias, or reallocating to what seems to be a more known and comfortable market: your own. In fact, developed international stocks (as measured by the MSCI EAFE Index) have handily outperformed the U.S. over the past 12–18 months, and if you believe in valuations and dividends over the medium to longer term (as we do), the EAFE and EM markets are offering attractive potentials for the patient investor.

3. If you are sitting on cash, maximize the yield on that cash and pay attention for reentry points. Right now, money market funds and other like-minded investments (such as our own USFR floating rate Treasury product) are offering yields approximating +/- 5%, a function of the highly “kinked” shape of the yield curve and far more than bank deposit rates. So, if you are sitting on cash, you may as well put it to work for you.

On the other hand, if you are looking for entry points back into the market, we recognize it is difficult to invest when there is fear or uncertainty in the market. But, as the market adage goes, “Be fearful when others are greedy, and greedy when others are fearful.”

Conclusion

These are the times when clients need their advisors the most. Keep them informed, keep them calm, keep them invested and identify opportunities for turning market turmoil into proactive and positive results.

Financial advisors interested in learning more about WisdomTree’s services can fill out the form below or send us an email at wtpg@wisdomtree.com.

Contact Us