Ten Fast Facts for DGRS’s 10-Year Anniversary

Small-cap investing is tricky, and there are myriad ways to pursue alpha relative to traditional, market cap-weighted benchmarks like the Russell 2000. Managers routinely combine factors to obtain exposure and experiment with different weighting mechanics, hoping their preferred small-cap recipe delivers improved risk-adjusted returns.

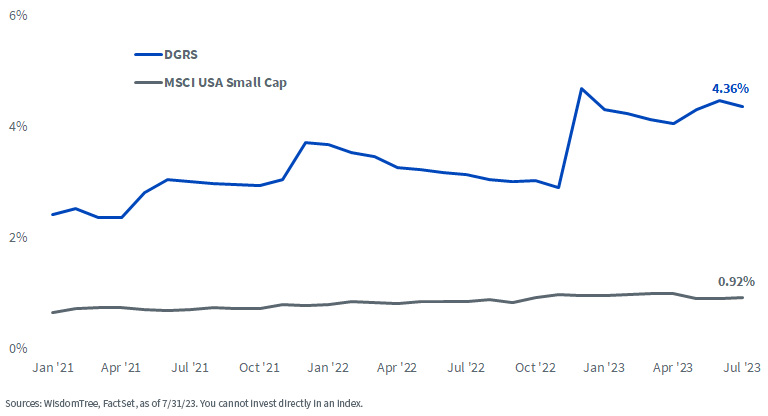

We are no exception. This past month, the WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS) celebrated 10 years since inception. Like its large-cap sibling (the WisdomTree U.S. Quality Dividend Growth Fund, DGRW), DGRS applies one of WisdomTree’s flagship factor methodologies to the U.S. small-cap space by marrying quality and dividend growth, alongside size.

In honor of its 10-year anniversary, here are 10 “fast facts” about DGRS to consider for a U.S. small-cap allocation:

1. Category leadership: DGRS was recently promoted to a 4-star fund ranking within the Morningstar U.S. Small Value universe, a testament to its performance leadership since inception. It finished in the top 28th percentile of all 326 funds in the category and delivered 0.87% of outperformance (at NAV) compared to the category index over the 10-year period.

Ranking as of 10/31/23. The Morningstar Rating™ for funds, or “star rating,” is calculated for managed products with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance.

The top 10% of products in each product category receive five stars, the next 22.5% receive four stars, the next 35% receive three stars, the next 22.5% receive two stars, and the bottom 10% receive one star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three- and five-year Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns.

2. A performance track record of success: Although DGRS impressed within its Morningstar category, it has succeeded against the most recognized small-cap gauges as well. It consistently outperformed both the Russell 2000 and Russell 2000 Value benchmarks over the short-, medium- and long-term, and in some cases, by several hundred basis points.

3. Volatility reduction: Perhaps most impressive is the risk profile of DGRS, which looks quite like the prevailing volatility of the Russell 2000 and Russell 2000 Value indexes. Small caps are already a high-risk segment of U.S. equity markets due to their size and business lines, so incremental volatility for most investors is only added with an abundance of caution and a reasonable expectation of additional return compensation. DGRS delivered impressive outperformance with virtually identical volatility to the broader small-cap market, providing strong risk-adjusted returns due to its factor methodology.

4. Consistency in recent cycles: DGRS's outperformance, coupled with reduced volatility, is not a temporary success story, either. It persisted over some of the most volatile market periods in recent memory. Over the past three- and five-year periods, which included the pandemic-induced market collapse of 2020, the subsequent recovery and bull market of 2021, followed by the steady declines of 2022, DGRS has captured more upside and virtually identical downside compared to broader small caps. This led to capture ratios above 100% over these periods, indicative of the Fund’s success.

5. Reduced bank exposure: While the regional banking crisis from earlier this year remains a foremost concern, it’s important to realize that DGRS is structurally underweight in these banks due to its factor methodology. Banks, by the nature of their business and balance sheets, tend to have higher returns on equity (ROE) and lower returns on assets (ROA), two key ingredients within a quality framework. WisdomTree’s quality methodology allocates to companies that score highly on both measures, and the low ROA of companies in the small-cap bank universe meaningfully reduces their exposure in DGRS. As of July, DGRS has less than half the diversified and regional bank exposure of the Russell 2000 Value Index, at 7% versus 16%. At the sector-level, DGRS has averaged nearly an 8% underweight allocation to Financials over the past five years. If banking concerns remain top of mind within the small-cap space, investors may be comforted by single-digit exposures within DGRS when many other small-cap factor strategies regularly have over 10% exposure.

Historical Average Sector Over/Underweights versus Russell 2000 Value

6. Factor success in small-cap markets: Factor investing has become increasingly important for small caps. Decades of research efforts studied the validity of the “size premium,” the concept that small caps will eventually outperform larger companies over time. Initial results confirmed its existence, and it appeared that investors (those who could endure the inherent riskiness of small caps) would be rewarded over the long term. However, subsequent studies1 indicate that the relationship has deteriorated over the last few decades, suggesting instead that small-cap success is predicated on which companies you own and which you do not. Pairing quality and size became imperative. It enables small-cap allocators to target the healthier corners of the small-cap market while avoiding broader swaths of junky companies. DGRS's quality dividend growth methodology packages the robustness of quality, the income potential of value and inherent size exposure for a factor blend that may have more long-term success than size alone.

7. Quality promotes margin defense: Earlier this year, I wrote a blog post demonstrating that quality companies can potentially hedge inflation due to improved price power. The logic was that they can pass off rising labor and input costs to their customers via higher prices, which defends their profit margins while inflation erodes them for more vulnerable businesses. This holds true today, even as we move past peak inflation in the U.S.

If we look at the top two deciles of companies ranked by WisdomTree’s quality methodology within DGRS, we find that their aggregate profit margin is roughly 3.5% greater than they are within the MSCI USA Small Caps Index universe. Since these are stocks common to both, the improvement is a direct result of DGRS's weighting scheme. By dividend-weighting a high-quality stock basket, DGRS delivers robust profit margins during periods when inflation introduces margin pressure. In our view, this highlights another shortcoming of market cap-weighting U.S. small caps.

Profit Margins of Top 2 Deciles by WT Quality Score among Common Holdings

8. Quality tilts to healthier small-cap companies: WisdomTree’s quality framework is designed to deliver more exposure to stronger, healthier, efficient companies, evidenced by improvements in ROE and ROA. These measure the efficiency of equity capital and asset usage in delivering profits for the firm, and DGRS excels versus the broader small-cap and small-cap value markets by design. These companies and their business lines may be more insulated from cyclical economic weakness due to stronger financials and efficient operations, providing a potential defensive boost to a portfolio.

9. Emphasizing profits: Perhaps just as important is a reduced allocation to companies that are currently unprofitable based on trailing 12-month earnings. There’s a preponderance of unprofitable companies in the U.S. small-cap universe, such that they make up roughly 25% of both the Russell 2000 and Russell 2000 Value indexes, but DGRS almost avoids them entirely. As of July-end, DGRS has about one-fifth the exposure to unprofitable companies that the Russell indexes provide. Once again, the WisdomTree quality framework results in allocations to companies with stronger underlying financial health and proven track records of generating profits.

10. No sacrifice on valuations: Investors might reasonably expect that the improved quality profile of DGRS would result in steep valuations relative to the broader market. Fortunately, however, that’s not the case. At the end of July, DGRS traded at multiples modestly higher than the Russell 2000 Value on a forward and trailing earnings basis but below those of the Russell 2000 core small-cap market. Once again, this is a by-product of the underlying methodology. The emphasis on fundamentals directly results in reduced valuations, allowing investors to avoid having to pay lofty premiums in exchange for improved quality profiles.

Cheers to 10 years, DGRS! May the next 10 be just as fruitful.

1 Clifford Asness, Andrea Frazzini, Ronen Israel, Tobias J. Moskowitz, Lasse H. Pedersen, “Size Matters, If You Control Your Junk,” Journal of Financial Economics, Volume 129, Issue 3, 2018, Pages 479-509, ISSN 0304-405X, https://doi.org/10.1016/j.jfineco.2018.05.006, (https://www.sciencedirect.com/science/article/pii/S0304405X18301326)

Important Risks Related to this Article

Morningstar percentile rankings are based on a fund’s average annual total return relative to all funds in the same Morningstar category, which includes both mutual funds and ETFs and does not include the effect of sales charges. Fund performance used within the ranking reflects certain fee waivers, without which returns and Morningstar rankings would have been lower. The highest (or most favorable) percentile rank is 1, and the lowest (or least favorable) percentile rank is 100. Past performance does not guarantee future results.

Morningstar, Inc. All Rights Reserved. The information herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.