Multifactor

At WisdomTree, our Modern Alpha® strategies are designed to combine the outperformance potential of active with the benefits of a rules-based approach. And today, no discussion of outperformance can be complete without factors (certain equity attributes that may be associated with higher returns). While there are many ways to gain individual exposure to value, size, quality, momentum and low volatility, we believe multifactor strategies can be powerful tools that provide numerous advantages to all investors.

A New Breed of Active

In the search for alpha, the closer to “beta” a strategy is, the less outperformance potential it can provide. And alternatively, the more “active” a strategy is, the greater the risks an investor accepts. But we believe there is something that can combine the benefits of both.

Our Multifactor Approach

Our innovative multifactor approach:

- risk-adjusted returns

- Blends fundamental factors such as value and quality with technical indicators such as momentum and low correlation to create a systematic, proprietary stock selection and weighting model

- Leverages a currency management overlay can help enhance return potential and lower volatility in international markets

- Seek to balance the risks of factor imbalance, sector and country bets and stock selection inherent in active mandates

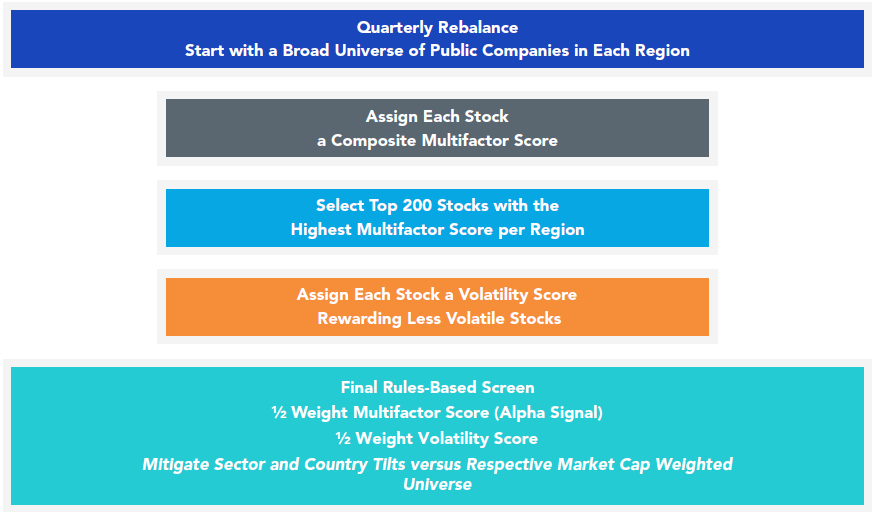

Here is a summary of our initial stock screening process:

Our Multifactor Family

The WisdomTree International Multifactor Fund can help investors to alpha while reducing the risks and costs of active managers through systematic multifactor exposure with a dynamic currency hedge overlay to international stocks outside the United States and Canada.