Thin-Margin Companies Will Feel Inflation’s Pinch

Whether it’s from house hunting, a rent raise or a visit to a car lot, everyone has a 2021 inflation story.

But until now, Corporate America has been able to march along to record profits as the world recovers from the COVID-19-inspired depression. The Street consensus S&P 500 operating earnings estimate for 2021 is $211, with a further rise to $223 being penciled in for next year. That puts the S&P’s earnings multiples at 20.6x and 19.5x, respectively, based on its recent trading level of 4,345.

That’s not too lofty if you consider another route: 0% interest on a savings account.

But what happens if earnings disappoint? I think the driver would be margin pressure from both wage and input cost inflation.

Should that scenario come to pass, stocks that rank low in screens for the quality factor are the trouble spot.

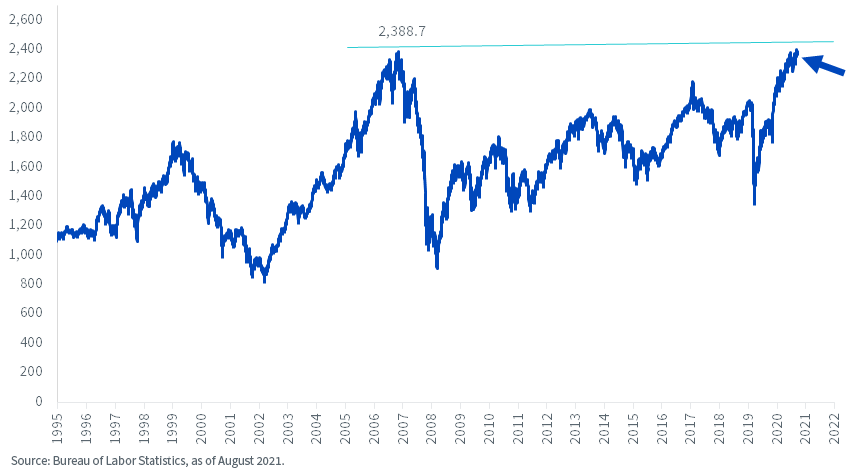

When average weekly household earnings witnessed a sudden spike above $1,000 in 2020, many among us pointed out the anomalous nature of the move. It happened, we stated, because high-paid laptop workers kept their jobs while baristas were tossed out en masse. The arithmetic sent the average northward.

Now that low-wage workers are coming back, the average should have retraced. But it has not. For many companies, paying the rank and file $980 per week could have been low enough threshold to turn a profit. At $1,066 per week, it may be a different story (figure 1).

Figure 1: U.S. Average Weekly Earnings of All Employees, Total Private ($)

I am not sure what would take the pressure off wages now that my eyes are set on a sub-5% unemployment rate any month now.

Employees are going to ask for raises.

If you have been to an auto dealership in recent months, you know that you will pay through the nose for both new and used vehicles.

In August, the average new vehicle in the U.S. sold for $43,355, according to Kelley Blue Book. But because so many parts are on back order, customers who need to purchase a car or truck right now are often paying more for 2018 and 2019 models than the original sticker price.

That is the type of expenditure that sends employees into the boss’s office to have THE conversation.

Home prices are also moon shooting. The 3.0% national average conforming mortgage rate has conspired with stimulus money to send the S&P CoreLogic Case-Shiller 20-City Composite Home Price Index up 19% in the year to August.

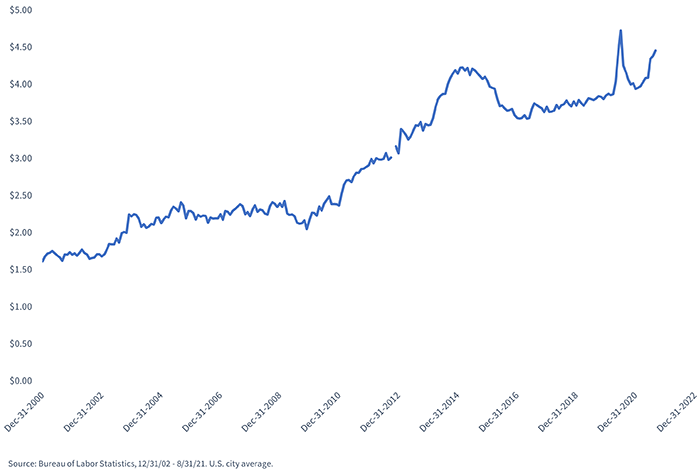

Sure, stimulus money sent car and house prices sky-high. But what is the excuse for the jump in the price of ground beef, which is about $4.50 per pound, up from about $3.50 in recent memory (figure 2)?

Figure 2: U.S. Average Price: Ground Beef, Per Lb.

It’s not like we are collectively eating much more or less of it. It’s because of all the new money sloshing around, created by the Federal Reserve (Fed).

Beef is not the only food whose price has gotten dear. Using NielsenIQ data, NBC News tracks it and five other common supermarket items. From October 3, 2020, to August 28, 2021, orange juice, chicken, bread, eggs and bacon each saw prices rise 4%–16%.

There is respite.

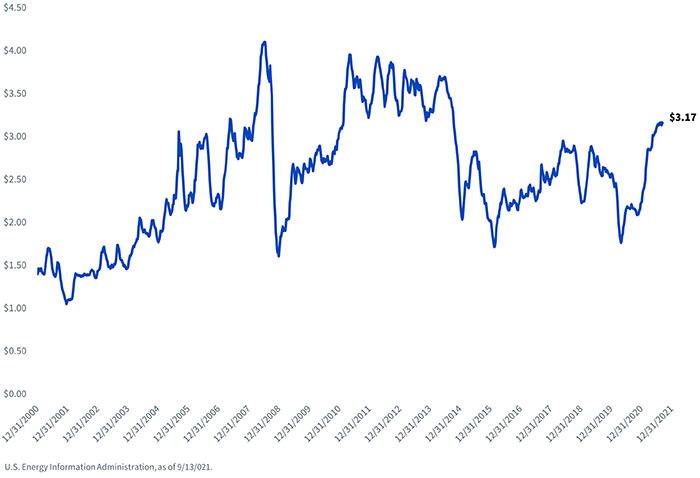

The national average gasoline price has popped, but at $3.17, it is still well below the $4 peak from the commodity supercycle years (figure 3). Additionally, late-model cars are much more fuel efficient than the ones we owned a generation ago, so it may take a number well north of $4 to really hit consumers’ wallets. Nevertheless, with oil prices in the ascendant, the gasoline price may continue to be pushed higher.

Figure 3: U.S. Regular All Formulations Gas Price

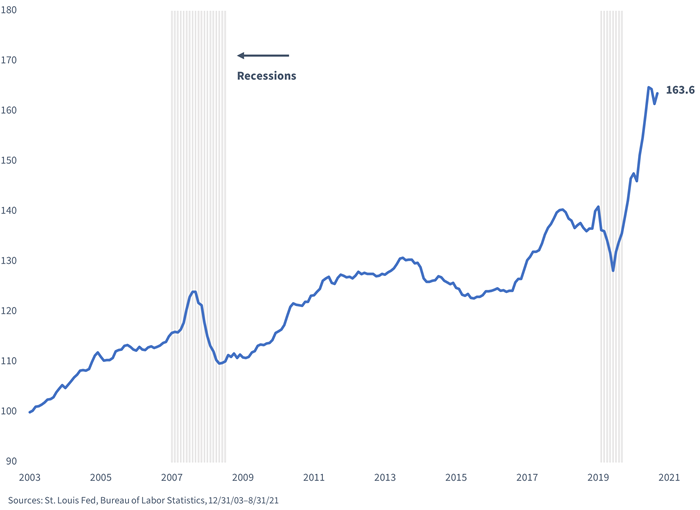

Also, paying more to fill up an 18-wheeler that is bound for the other side of the country hurts acutely when you are paying the truck driver $87,000 per year. That is the number Walmart is laying on the table—plus a signing bonus—in its current postings. Just look at figure 4.

Figure 4: U.S. Producer Price Index: General Freight Trucking, Long-Distance Truckload

The combination of rising energy, transportation and labor costs—not to mention supply chain frustrations—poses an obstacle to firms that have questionable profitability.

Levering up thin profit margins to present a robust return on equity (ROE) can work just fine when operating costs are kept at bay. The problem is what happens when that scenario changes, when leverage works the other way in red ink situations.

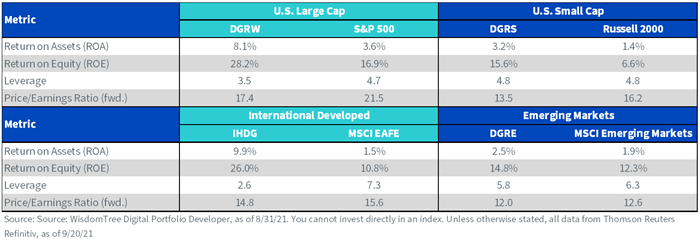

Here is a small sample of WisdomTree products that rank high on ROE and ROA (return on assets), with the interaction of the two giving you an idea of business risk in the form of leverage (figure 5). If profit margins take a hit in the coming quarters, these high ROA and high ROE ideas may save face.

Figure 5: Quality Metrics by Asset Class

For definitions of terms in the chart, please visit the glossary.

Funds Referenced in figure 5:

DRGW: WisdomTree U.S. Quality Dividend Growth Fund

DGRS: WisdomTree U.S. SmallCap Quality Dividend Growth Fund

IHDG: WisdomTree International Hedged Quality Dividend Growth Fund

DGRE: WisdomTree Emerging Markets Quality Dividend Growth Fund

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. To the extent the Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is likely to be impacted by the events or conditions affecting that country or region. Dividends are not guaranteed and a company currently paying dividends may cease paying dividends at any time. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile, and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. The Fund invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. Funds focusing on a single sector generally experience greater price volatility. Investments in emerging, offshore or frontier markets are generally less liquid and less efficient than developed markets and are subject to additional risks, such as of adverse governmental regulation, intervention and political developments. Due to the investment strategy of this Fund, it may make higher capital gain distributions than other ETFs.