Currency-Hedged International Strategies for Exposure to China Reopening

Chinese equities soared following the easing of zero-COVID policies late last year. But is this reopening now fully priced in? And what other opportunities are there around this important macro catalyst?

Other tailwinds received less attention. Both the easing of regulation on China’s own tech giants and a long sought-after agreement between U.S. and Chinese authorities over the audit authority of U.S. regulators are positive developments for China’s capital markets.

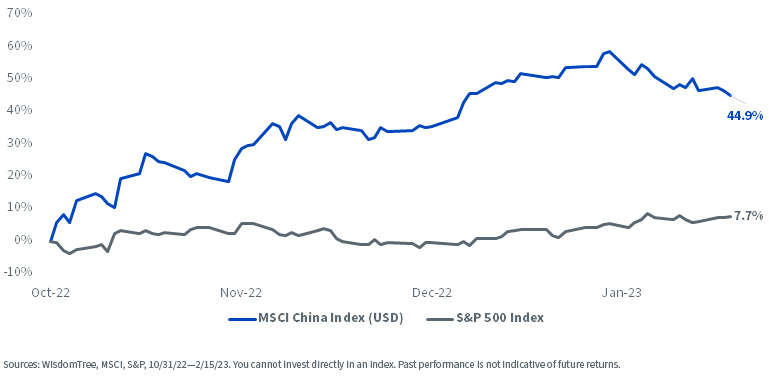

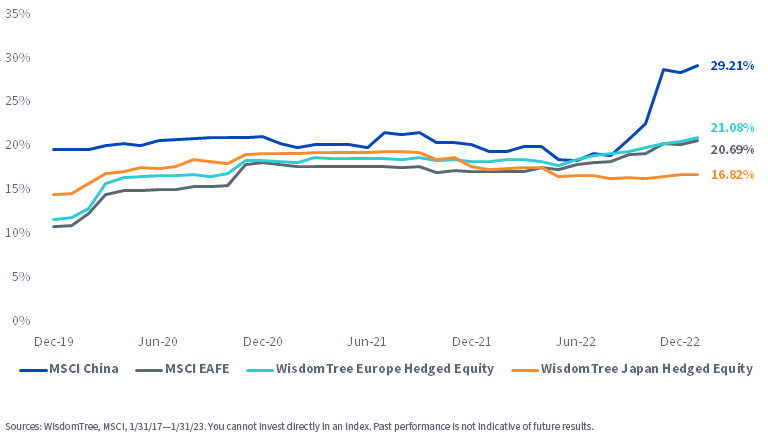

Since the end of October, the MSCI China Index has had total returns of almost 45%, while the S&P 500 has returned 7.7%.

Cumulative Index Total Returns

China Reopening Exposure with Less China-Specific Volatility

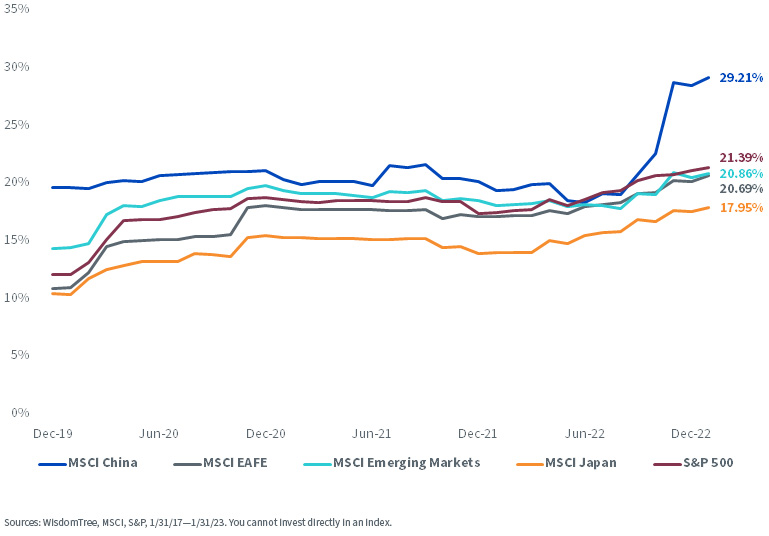

Some investors may want to access the China reopening theme without the volatility of investing directly in Chinese equities, which can be rife with existential geopolitical risk.

S&P 500 vs. WisdomTree Funds—Percentage of Revenue From China

Rolling 36-Month Volatility

For definitions of indexes in the chart above, please visit the glossary.

The reopening of Chinese borders should be especially fortuitous for companies that sell to Chinese consumers as travel picks up. The summer travel season should be robust.

Multinational companies, like Japanese exporters, also look well-placed to benefit. China is Japan’s largest export destination, and provides ample demand for goods like cars and semiconductors.

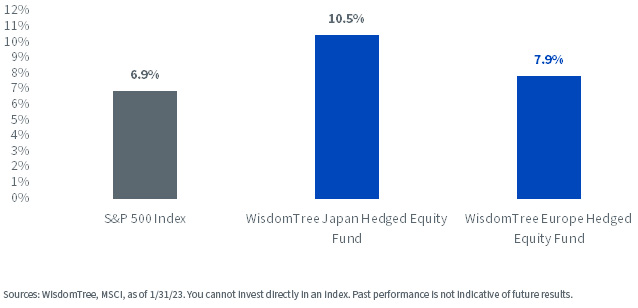

The WisdomTree Japan Hedged Equity Fund (DXJ) seeks to provide exposure to such multinational companies that are less reliant on Japan’s local economy, while also mitigating exposure to yen fluctuations.

Revenue Exposure to Japan

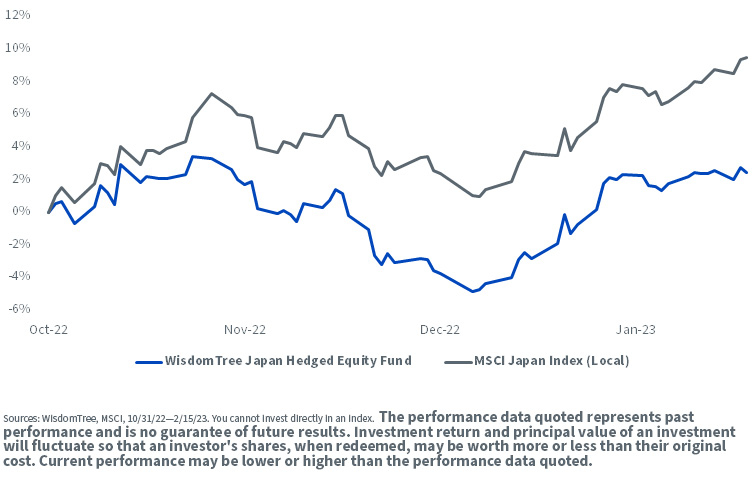

Since last November, when China began to roll back COVID-related restrictions, DXJ has outperformed the MSCI Japan Index by over 4% in local currencies.

WisdomTree Japan Hedged Equity vs. MSCI Japan Returns

For the most recent month-end performance, please visit www.wisdomtree.com/investments. For standardized performance click here.

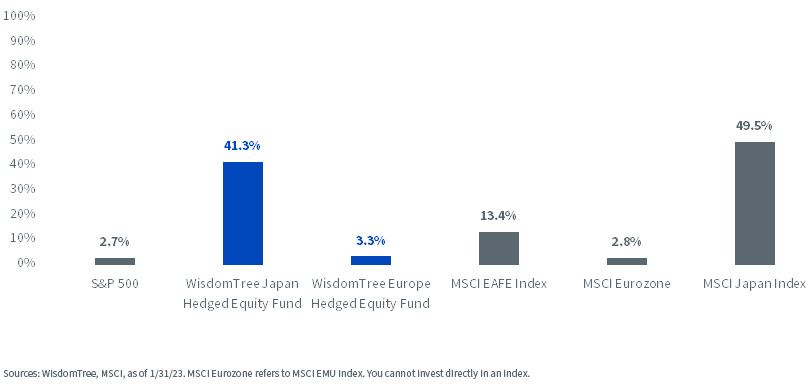

Whether the dollar-yen rate climbs back to its October peak or tumbles back down to pre-pandemic levels, DXJ may enable investors to pursue returns solely based on equity performance, potentially mitigating completely the effect of any changes in the exchange rate.

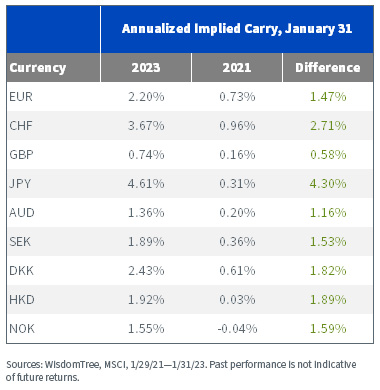

Given interest rate differentials between the U.S. and Japan, there is also a 5% hedging credit due to the interest rate differentials—known as the carry trade—that unhedged exposures have to make up. Far from being expensive to hedge, as some investors have worried in the past, there is significant carry now in Japan-hedged strategies because of the Fed’s policies.

Positive Carry Trade

Europe

Turning our attention to the West, Europe is off to a good start in 2023.

The Russian invasion of Ukraine last year set off an energy crisis that saw oil, coal, gas and electricity prices skyrocket, putting additional upward pressure on rising inflation. However, energy prices cooled in the following months, falling below pre-war levels and allowing the European economy to narrowly avoid a previously forecasted recession.

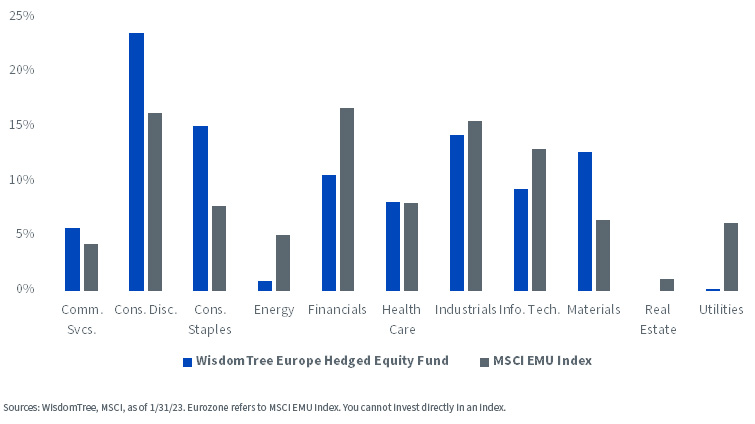

The WisdomTree Europe Hedged Equity Fund (HEDJ) provides exposure to eurozone equities, and similarly to DXJ, seeks to hedge against movements of the dollar versus the euro. HEDJ also has an exporter tilt, only selecting firms that generate at least 50% of revenue outside of Europe.

WisdomTree Europe Hedged Equity vs. Eurozone Sector Exposures

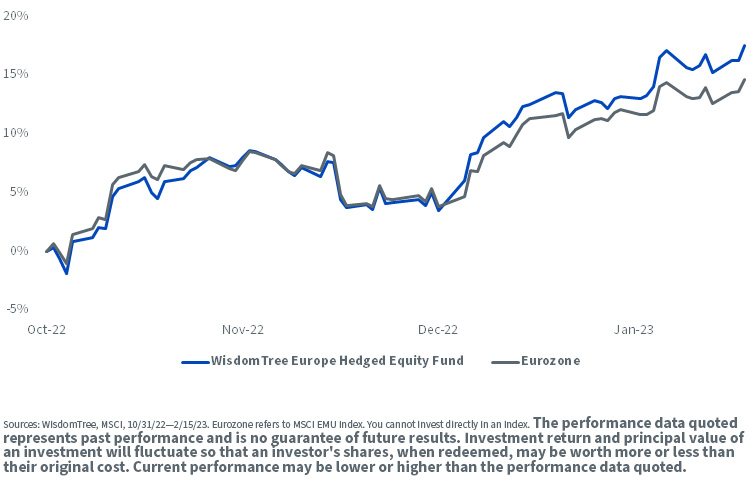

Like their Japanese counterparts, European exporters have been experiencing tailwinds from China’s reopening and out-performing broader international benchmarks recently.

China is Europe’s third-largest importer, and the Chinese market is among the largest for European consumer goods. European manufacturers also rely heavily on Chinese machinery and equipment, and may look forward to smoother logistics as borders reopen fully. HEDJ outperformed the MSCI EMU Index by over 7% since last November in local currency terms.

WisdomTree Europe Hedged Equity vs. Eurozone Returns

For the most recent month-end performance, please visit www.wisdomtree.com/investments. For standardized performance click here.

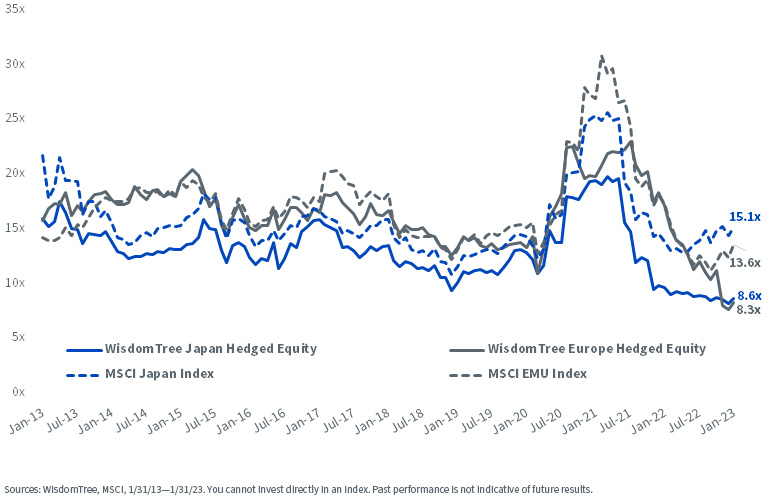

We believe that from a fundamentals perspective, HEDJ and DXJ have both traded at discounts for most of the last 10 years relative to their MSCI regional benchmarks. These discounts have been deepening further since the start of 2022.

WisdomTree Funds vs. MSCI Index Price-to-Earnings

For definitions of indexes in the chart above, please visit the glossary.

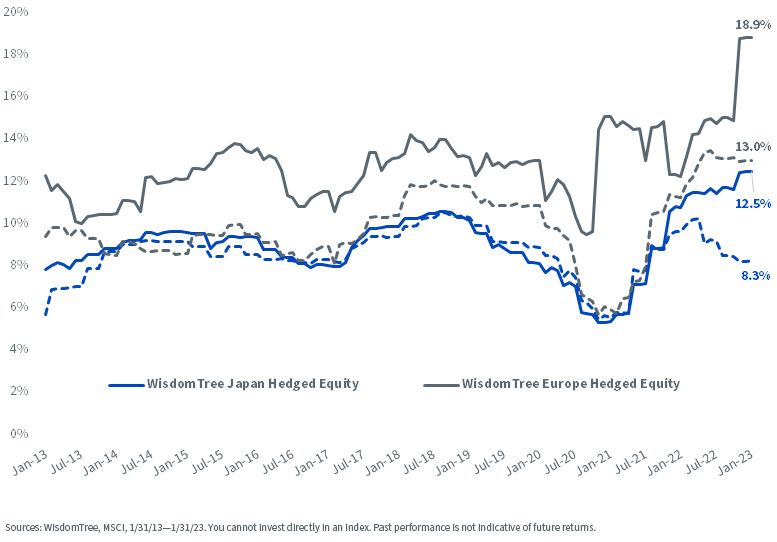

HEDJ has consistently provided investors with a greater return on equity (ROE) than the MSCI EMU index, and the spread between DXJ and the MSCI Japan Index’s ROE has been widening since late 2021.

WisdomTree Funds vs. MSCI Index ROE

Amid major economic and political developments in two of the largest economies in the world, which cannot be described as anything but historic, DXJ and HEDJ can help investors gain exposure to developed markets outside of the U.S. and tilt their portfolios more toward exporters, who are expected to benefit from the reopening of Chinese borders.

The two Funds also may allow investors to dodge unfavorable developments in currency exchange rates thanks to their fully currency-hedged strategies, which may prove useful as central banks around the world (the Bank of Japan, in particular) adjust monetary policies to navigate an increasingly volatile 2023.

Additionally, they can provide exposure to China without the added volatility of currency risk that can come from unhedged investments in international equities.

Rolling 36-Month Volatilities, WisdomTree Funds vs. MSCI Benchmarks

For definitions of indexes in the chart above, please visit the glossary.

Important Risks Related to this Article

DXJ: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

HEDJ: There are risks associated with investing, including the possible loss of principal. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in currency involve additional special risks, such as credit risk and interest rate fluctuations. Derivative investments can be volatile and these investments may be less liquid than other securities, and more sensitive to the effect of varied economic conditions. As this Fund can have a high concentration in some issuers, the Fund can be adversely impacted by changes affecting those issuers. Due to the investment strategy of this Fund it may make higher capital gain distributions than other ETFs. Dividends are not guaranteed, and a company currently paying dividends may cease paying dividends at any time. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.